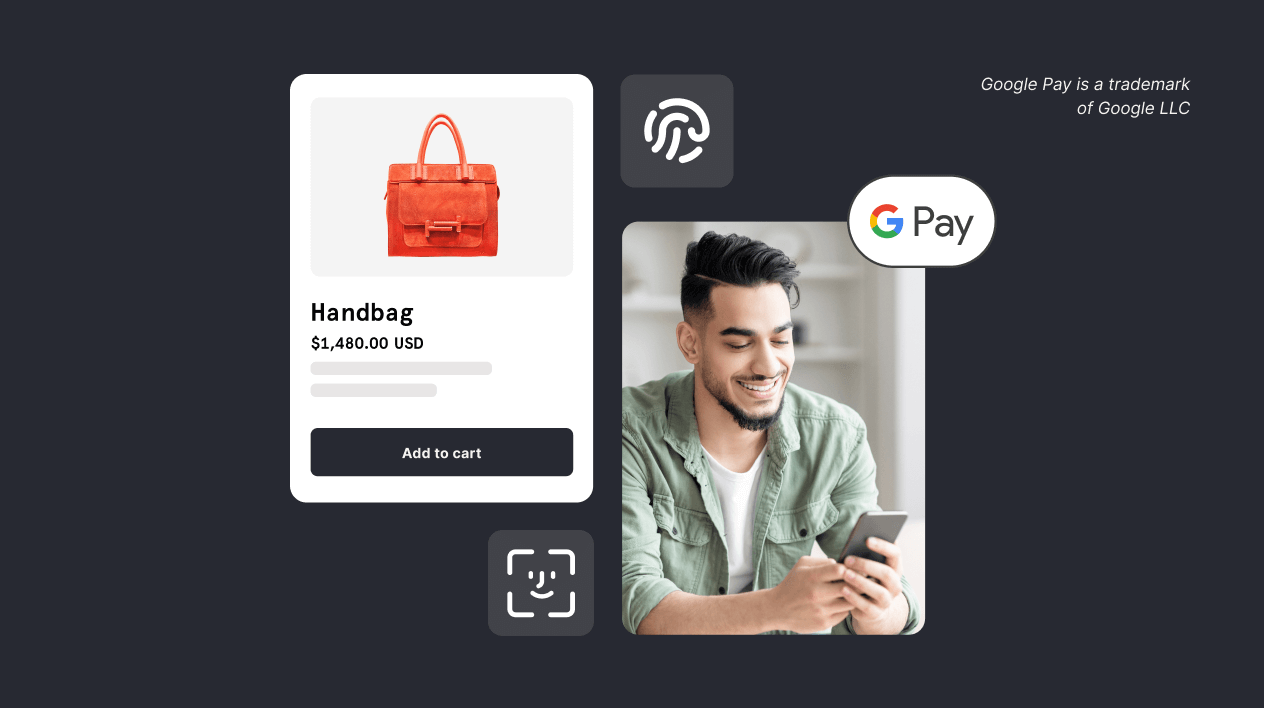

Checkout deploys biometrics in Google Pay

British unicorn Checkout, an online payment specialist, has teamed up with Google to establish itself as the first payment service provider to offer a biometric authentication solution in conjunction with Google Pay. Its service will enable merchants to offer a faster, more secure payment experience via Google Pay.

FACTS

- Checkout.com, a world leader in digital payments, now offers a biometric authentication solution in partnership with Google Pay.

- This service enables merchants to offer a smoother, more secure payment experience by using methods such as PIN, password or facial recognition to validate transactions.

- Checkout underlines the fact that its technology accelerates payments by an average of 30%, increasing the authentication rate by 5 points and the authorization success rate by 3 points.

- To complement this new service, accepting merchants are also invited to integrate Checkout.com's AI-based dynamic routing.

- Companies like Remitly are already benefiting from this solution, which simplifies authentication by avoiding the multiple steps usually required.

CHALLENGES

- Optimizing the process: Prior to its partnership with Checkout.com, Google Pay managed its biometric authentication solutions using the biometric capabilities built into the Android and iOS operating systems. This method offered a smooth and secure user experience, but relied heavily on the device's native security features rather than an external payment processor or partner.

- Increase authentication speed: The integration of biometrics into digital payments aims to address the challenges posed by traditional authentication methods, often perceived as slow and inconvenient.

- Reduce friction in the checkout process: By reducing friction in the checkout process, Checkout technology has the potential to improve conversion rates, reduce cart abandonment, and increase authorization success rates.

- Increased retailer performance: This represents a major asset for merchants seeking to optimize their performance in an increasingly competitive market.

MARKET PERSPECTIVE

- The digital payments market is evolving rapidly, with growing demand for solutions that combine security and simplicity. Biometric authentication, as a more modern and secure alternative to traditional systems such as 3DS, is set to become standard.

- Companies that quickly adopt these technologies could not only strengthen customer loyalty, but also gain in operational efficiency. Checkout.com is thus positioning itself as a pioneer, paving the way for a new era of payment services tailored to the needs of modern consumers.