Bourgeois Boheme, the new fintech for the wealthy

Bourgeois Boheme (BoBo), a Lithuanian fintech, raised 6.5 million euros over the summer to support the rollout of its platform, billed as innovative, aimed at high-net-worth individuals. In particular, the start-up offers a digital solution for managing cash flows and high-value transactions up to €1 million, with AI-enhanced security.

FACTS

- Bourgeois Boheme (BoBo), a European fintech focused on financial services for high-net-worth individuals, recently raised €6.5 million in a round of financing led by Graphit Lifestyle.

- The start-up, based in Lithuania, will be able to count on this new sum to roll out its offering. It offers an innovative platform capable of digitizing cash flow management and facilitating high-value banking transactions, with ceilings of up to €1 million per transaction.

- BoBo uses advanced security systems, supported by artificial intelligence technology, to ensure the transparency and security of its transactions.

- The platform also offers its customers unique functionalities, such as account management by authorized third parties and the integration of payment chips into personalized accessories.

- Three levels of membership are available:

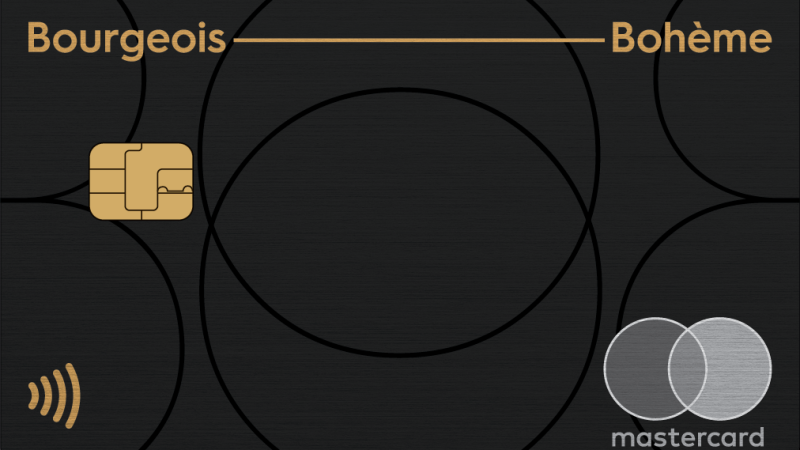

- Starter (including a digital account for daily use, customer support, a metal card and a luxury payment keyring),

- Member (including a digital account, a contactless Gold card, a luxury payment accessory, on-demand concierge services and other complementary services),

- VIP (including a digital account, an all-gold-certified luxury contactless Mastercard, a luxury payment accessory, personal assistance and other complementary services).

- Future BoBo customers are invited to join a waiting list for the time being, prior to the official launch of the fintech's services.

CHALLENGES

- A solution for a niche market: Bourgeois Boheme (BoBo) specifically targets high net worth customers. BoBo's ideal customers generally have assets of at least $1 million (“high-net-worth individuals”), or $30 million (“ultra-high-net-worth individuals”).

- Targeting younger people: BoBo's niche is the younger, more affluent, technology-savvy segment. The fintech believes it can better meet their needs with a modernized, more technological approach.

MARKET PERSPECTIVE

- BoBo's ability to offer innovative, secure solutions to the most affluent customers seems convincing. The company currently has over 220 individual customers and over 1,000 prospects on its waiting list. For services, it relies on a partner network of over 25 companies.