Capital One Handles Virtual Cards through a Chatbot

Alongside the growth of the e-commerce sector and increased number of subscription models, payment instruments have also evolved. Capital One presents a new service enabling its customers to generate virtual cards using a smart assistant called Eno. The idea is to make it easier for them to rely on this security tool when paying online.

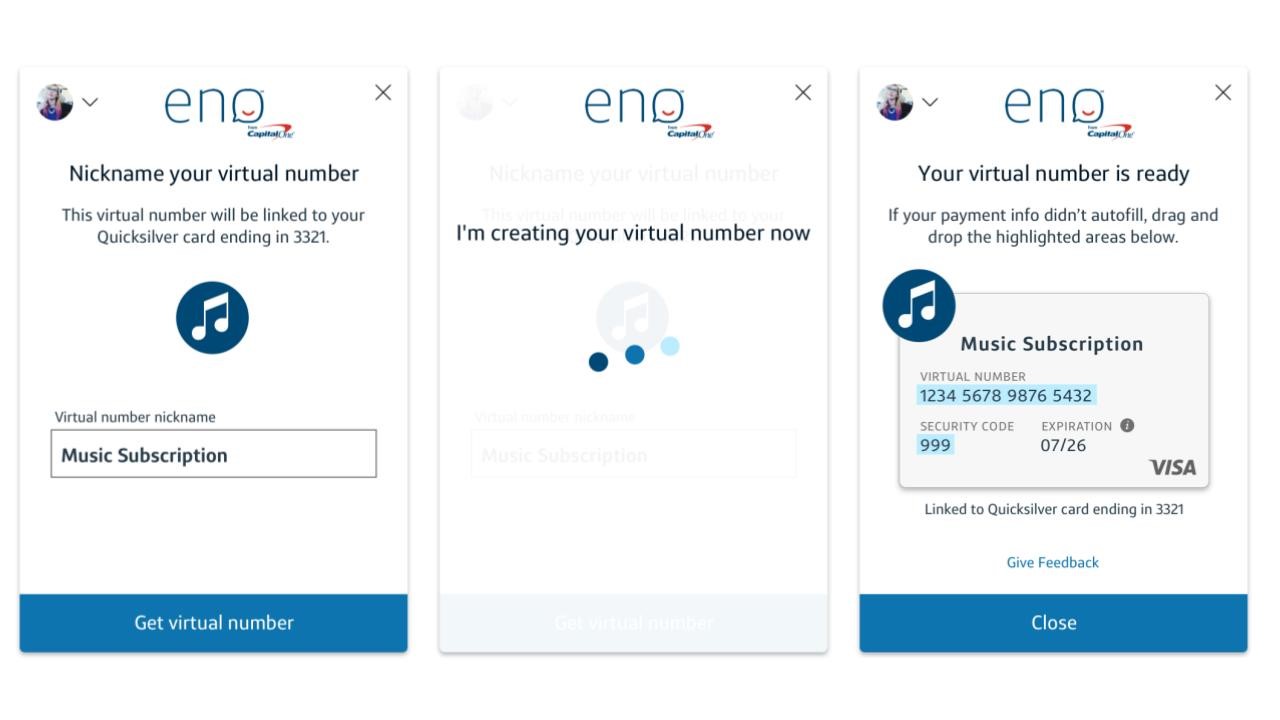

Eno is a text-based virtual assistant helping Capital One customers manage general operations: track their monthly credit card fees, check their account balance, latest transactions, bill payments, etc. Capital One is adding a new feature for this chatbot, allowing its customers to generate virtual card numbers.

This service relies on a plug-in for Google Chrome and Firefox, making it possible for its users to stay connected to Eno. This assistant automatically identifies and auto-fills e-merchants’ payment pages. For the payment step, a virtual card number is instantly generated. These virtual cards can be reused. And all generated numbers can be managed from an online dashboard. Customers may then temporarily lock, unlock or delete them.

This institution plans to expand this service to all Web browsers, and include additional features: for instance, setting transaction limits, specifying time limits for such or such merchant, or generating one-time use numbers.

Comments – Capital One modernises virtual cards

According to Baymard Institute, cart abandonment rates keep increasing in the US (69.2% in 2017, +16% over an 11-month period). Also, 18% of these cart abandonments can be accounted for by customers’ fear when it comes to providing their card data online. In this context, virtual payment cards is nothing new: many banks already propose similar features (the e-Carte Bleue in France, for instance).

Capital One stands out as they rely on an easy to use process: their card numbers are generated instantly, changes apply automatically when replacing the associated plastic card and payment forms are also filled automatically when making a transaction. By way of comparison, e-Carte Bleue customers have to start the relevant plug-in, authenticate (via 3D-S), ask for a virtual card number, key in the transaction amount, then add the virtual card information in the payment fields… before they can actually complete their transaction. And this service comes at a cost. Capital One proposes a much easier solution through relying on their existing chatbot. This strategy may bear fruits, since most of their customers are already familiar with this tool, and the way it works: they only need to download the associated plug-in.