CaixaBank Crafts a Chatbot for Financing Purchases

FACTS

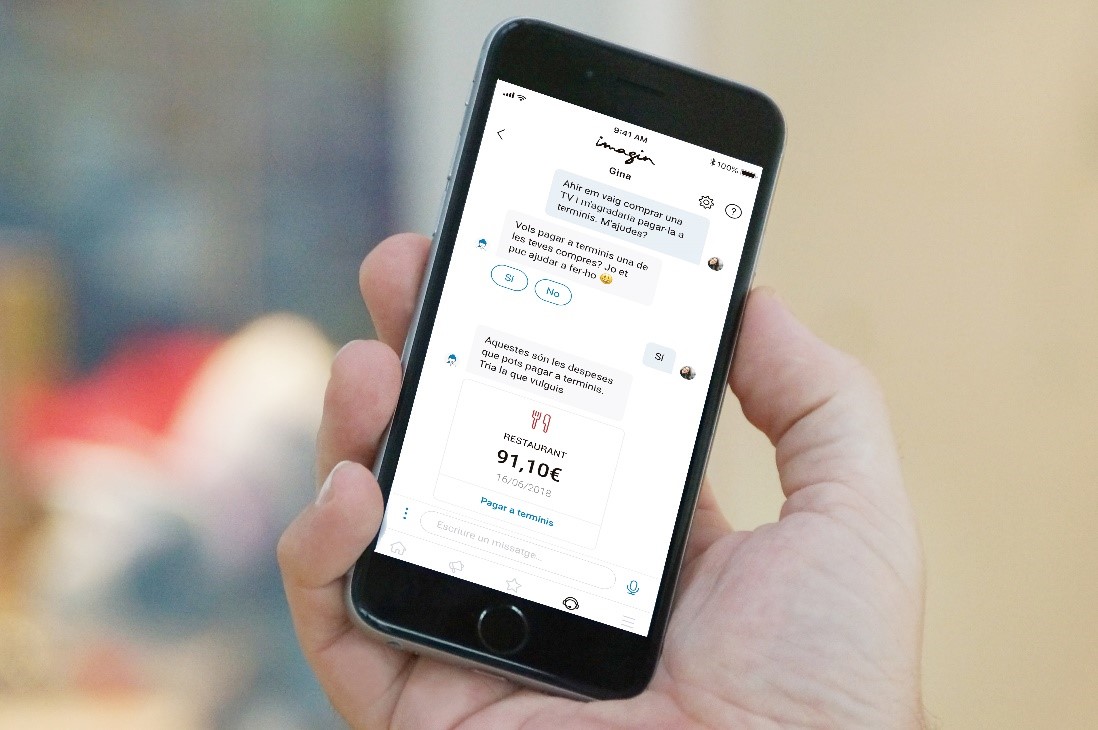

- CaixaBank launches a new service through their mobile bank imaginBank: their chatbot will now provide near-instant payment facilities.

- Digital transactions:

- Purchases paid using a card from the digital bank,

- Over the week before,

- For purchases worth at least €40,

- Payment options: 3, 6 or 9 times,

- This service works via Gina, the existing bot by imaginBank.

- Two use cases:

- This service can be activated by the customer asking Gina, via text or voice messages, to spread a recent payment over time. This bot can then detect the eligible transactions,

- The service may be activated by the bot, which is then able to detect when the customer may need to spread a payment over several instalments.

- The bot relies on AI and Big Data technologies to identify eligible consumers and exceptional operations likely to need a financing service.

- This feature has been added to the latest version of imaginBank mobile app in iOS. It will soon be made available in Android.

CHALLENGES

- With this feature, CaixaBank expects a 15% increase in instalments (up from currently 1,200 operations each month at imaginBank).

- Also, this Spanish digital bank may win new customers’ trust. It now claims 1.2 million customers, whose average age is 23.

- Strenghten their conversational strategy. After Gina for imaginBank customers, CaixaBank launched Neo, a virtual assistant providing information through the CaixaBankNow app. They go even further with an assistant embedding predictive features.

MARKET PERSPECTIVE

- This is the first mobile app in Spain to add credit offers based on AI and Machine Learning technologies. It is also one of the only apps allowing for proactive transactions using a robot. Up to now, other industry players mostly built tools for assisting customers through financing application: Yelloan, for instance, (whose chatbot is merely an alternative interface to filling out a form) or DKB (with a chatbot for tracking application status).

- Gina was launched by imaginBank in 2017 to help its users search for offers and discounts matching their needs and place of residence.