BPCE modernizes PER subscription

The BPCE Group announces the modernization of its PER with an online subscription. Wishing to continue its growth in the banking and insurance markets, BPCE relies on innovation to strengthen its position, as this new feature shows.

FACTS

The BPCE group now allows its customers to subscribe online to a retirement savings plan (PER) in minutes.

This initiative comes after the group found that almost 20% of the RIPs opened in 2024 had been in the group's banks.

To maintain its leadership, the group has invested to simplify the registration process by digitizing it.

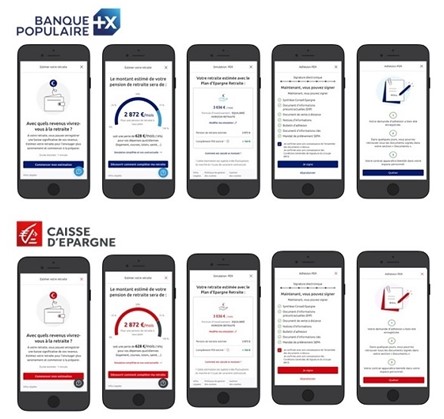

The presence of a simulator also allows customers to evaluate the amounts they can assemble as they progress. This allows clients to assess the amounts they will have at their disposal when they retire.

During the online subscription, the customer can also ask for the help of an advisor. He may decide to sign his contract directly online or to come and sign it in an agency.

The functionality will be offered in Banque Populaire and Caisse d'Epargne applications.

ISSUES

Meeting the needs of French: According to the BPCE Insurance Barometer, one in two French people said they were saving for their retirement. The Group therefore aims to offer an easy and quick way to realize its savings by opening a PER in just a few clicks. With the decrease in the number of agencies, having to travel to open a PER can become a barrier to subscription for some people. This new customer experience will therefore also convince the group's most distant banking agencies.

Implement the group's strategy: The creation of this new type of subscription is in line with the Vision 2030 plan, through which the group builds its strategy. In this plan, BPCE aims to become France's fourth insurer. For this, the group innovates and tries to attract customers with digital and simplified solutions.

PERSPECTIVE

In a similar logic of modernising savings, Bank Postale launched a new fund this week private equity for its private customers holding life and retirement insurance contracts. The aim is to support the local economy by investing in local businesses with an ecological impact.

Traditionally dedicated to wealthy customers and institutional investors, private equity is becoming increasingly accessible and offers an interesting alternative for individuals who want to invest in products with attractive rates.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate