BPCE grants its real estate credits according to the DPE

The BPCE group, through the Banques Populaires and Caisses d'Epargne, has just announced its ambition to integrate energy performance diagnostics (EPDs) into its real estate credit offerings. The banking group will propose concretely to accompany buyers beyond the financing of their new housing, including in their energy renovation. At the key, an enhanced rate for the most committed purchasers.

FACTS

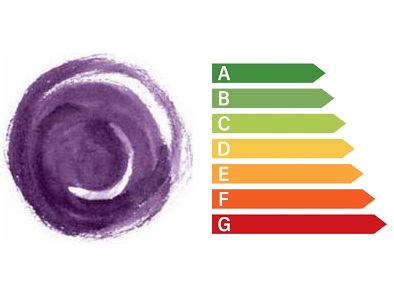

- Customers at Banques Populaires and Caisses d'Epargne who subscribe to new eligible real estate loans (excluding regulated loans, reviewable loans, infine loans, relay loans and duo loans) will now be eligible for a rate subsidy if they commit in the medium term to improving the energy efficiency of their housing with an Energy Performance Diagnostic (EPD) between E and G.

- BPCE would apply rate reductions of 0.10 to 0.30%.

- All dwellings are affected, whether they are ultimately used as principal, secondary or rental residences. The offer is also cumulative with obtaining a PTZ or loans with deferred repayment.

- In order to benefit from the offer, new borrowers will have to carry out energy renovations within three years (40 months) after the date of their first release of funds.

- In addition to a higher rate, owners will be able to benefit from the support of a network of energy renovation experts selected by BPCE. They will be assisted at each stage of their work, from the audit to the end of the project.

ISSUES

- Participate in the collective effort: In France, according to the Office of the Commissioner General for Sustainable Development, an agency of the Ministry of Ecological Transition, 4.8 million housing units, principal residences, were classified as energy passory (labels F and G of the energy performance diagnosis) at the end of 2023. This represents 15.7% of the park. However, the Energy and Climate laws of 2019 and Climate and Resilience laws of 2021 have introduced a minimum energy performance requirement for housing rental. In 2025, only A to F dwellings will be qualified as decent, and in 2032 this qualification will apply only to A to D dwellings. By proposing a solution to finance the purchase but also the energy renovation of the least rated dwellings, BPCE is committed to the energy renovation of the housing stock in France.

- Confirming commitments : This is not the first time that the BPCE Group is committed to supporting energy renewal of housing, which is a priority of its strategic project Vision 2030. If today the group is more specifically addressing access to real estate loans, Signed in June 2024 a new partnership with Leroy Merlin to support this time all the French in carrying out energy renovation work on their housing.

PERSPECTIVE

- The BPCE group will not be the first in France to propose this type of scheme based on the valorisation of the positive development of the DPEs of the housing financed. In July 2023 the Bank Postale put eco-responsibility in terms of the distribution of these real estate credits. The group then relied on its status as a company on mission to base its new real estate loan on a global impact indicator, under the supervision of the WWF environmental association.

- The Postal Bank thus granted a rate reduction of 0.20% for the financing of new, new or already renovated housing. The older goods, with PEs ranging from D to G and in which future purchasers undertook to carry out energy renovations at the time of their move-in, benefited from an increased rate of -0.30%.

- In November 2023, BoursoBank committed also reduce its rates for loans financing assets rated A, B or C in terms of CPE.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate