BNP Paribas Gives Priority to a Mobile Approach

As the year starts, adopting relevant distribution channels for banking services remains a priority. BNP Paribas stresses their focus on smartphones as they intend to comply with their customers’ expectations and with actual use cases. This approach is walking them to a “Mobile First” model.

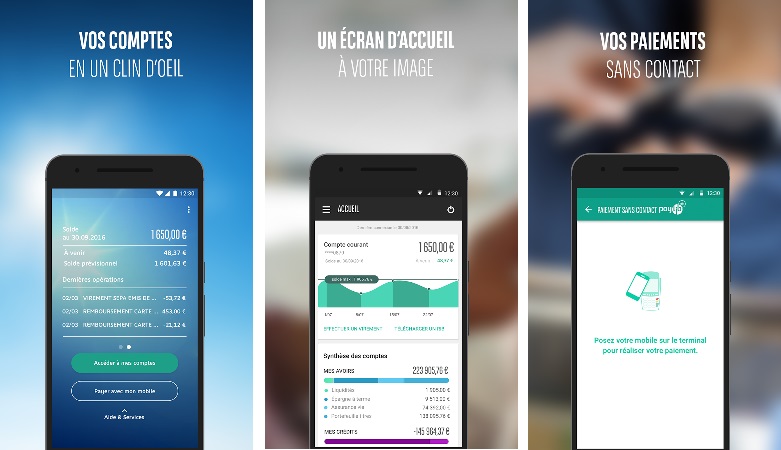

More than 1.2 million BNP Paribas customers in France now connect to their online portals via mobile. The banking institution commits to including their entire range of services in a single app: “Mes Comptes”.

This so-called “Mobile First” approach is meant to match today’s customer behaviours: two thirds of BNP customers’ connections to their e-banking portal are conducted from a mobile phone. And “mobile only” people would also be more active: logging on to their portal 15 times per month on average, compared to 12 times for Web and mobile connections.

Likewise, BNP Paribas is rolling out new services: cheque scans, an SMS-based P2P money transfer option, a payment card management tool, a chatbot for urgent requests, and even an instant mobile payment service.

Comments – Mobile strategies still prevail in 2018

The digital shift has long been underway for banks. And BNP Paribas is one of the pioneering groups to this respect: Hello Bank! was introduced in 2013. Since then, this brand, in combination with Cetelem, helped BNP Paribas enter additional markets, including Czech Republic for example.

BNP Paribas keeps building this strategy. Besides their mobile subsidiary, they also support an overall cross-channel approach. Regardless of their hard work, they have had to scale up their objectives, since customers’ actual use cases exceeded initial goals. This accounts for their seeking to craft tools that would properly match these developments.

BNP Paribas isn’t the only long-standing banking player to aim for this approach in 2018. BPCE gave thought to assisting their staff and bets on centralising their apps in a Store so they can add value to their mobile offer, including in-house for their employees. Yet another example: in Spain, CaixaBank unveiled a new brand, “Family Now”, and a mobile app intended to bring all their digital services in one place.