BNP Paribas and Expensya renew the management of professional expenses

BNP Paribas has announced that it will soon offer a paperless expense management solution. The launch of this future service, scheduled for next September, is the result of a partnership with the specialist FinTech Expensya. It will allow the traditional bank to enter a market covered by alternative players.

FACTS

-

From September, BNP Paribas corporate clients will benefit from a new service for the dematerialised management of expense reports.

-

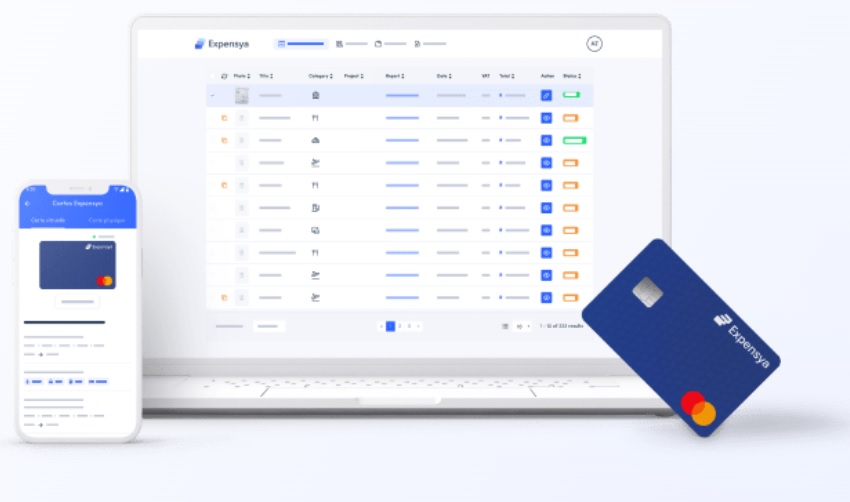

Designed in partnership with Expensya, this solution will be based on a mobile application linked to BNP Paribas corporate cards. It will allow users to automatically enter their expense reports by scanning their business expense receipts.

-

The system automatically scans all employee receipts to facilitate the validation, control and processing of their expense reports by their company's accounting departments.

-

In addition to BNP Paribas Corporate cards, the service will subsequently be available to users of BNP Paribas Procurement cards and professional virtual cards.

-

BNP Paribas also plans to extend its new service geographically. After France, it should also be offered by the bank in Belgium, Italy and Germany.

CHALLENGES

-

Accelerate expense processing: Expensya's service promises to reduce the processing time for business expenses by 80%.

-

Collaborate to compete better: This example of collaboration between BNP Paribas and Expensya, favouring the positioning of a traditional bank in a market covered by other FinTechs (such as Spendesk or Qonto for example) perfectly illustrates the ambivalence that currently governs the relationship between banks and FinTechs. The new service allows the bank to position itself on a market with high potential.

MARKET PERSPECTIVE

-

Last November, US Bank announced the acquisition of TravelBank, the FinTech behind an all-in-one business travel and expense management platform. The traditional American bank thus integrated the FinTech's services into its offer and opened up to expense management.

-

This diversification effort by a banking player now also concerns the expense management market. And today, with BNP Paribas, it underlines a global trend.