Banque de France satisfied with payment security in 2020

While the Covid crisis hit France hard and disrupted the consumption habits of the French population, the Banque de France expressed general satisfaction about the level of payment security and praised the efforts made by the industry in its latest Observatory.

FACTS

- As it does every year, the Banque de France Observatory has analyzed the evolution of the French payment ecosystem. The year 2020 was unusual, to say the least, given the health crisis.

- And yet, despite the increase in digital payment usage and online card payments, the fraud rate remained stable at 0.068%.

- The Banque de France Observatory also applauds the adoption of contactless payment at the point of sale, which has increased from one third of payments before the crisis to half. The increase in the payment limit from 30 to 50 euros in May 2020 has been accompanied by an increase in the level of security.

- The results are positive, as the Observatory has also witnessed a drop in the contactless fraud rate to its lowest level ever, at 0.013%.

- With the boom in Click and Collect, the Banque de France is also satisfied that the increase in online payments is associated with a stable fraud rate, at 0.174%.

CHALLENGES

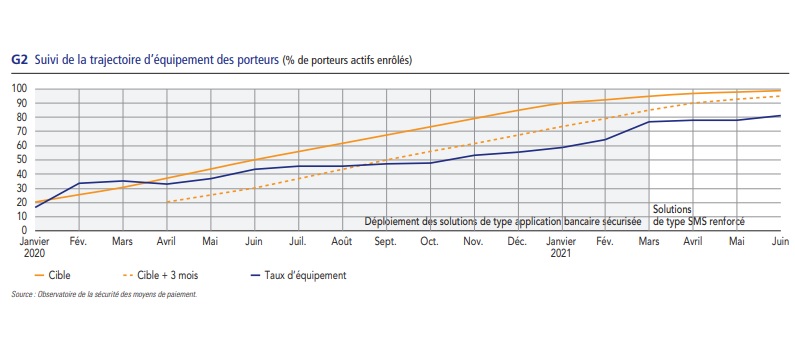

- The Banque de France is taking advantage of the publication of its Observatory to highlight the good results of the French market with regard to the deployment of strong authentication, which respects the objectives set. Thus, about 95% of the flows issued by French e-merchants comply with the regulatory requirements. More than 4 out of 5 Internet users making online card purchases validate their payment via a strong authentication device.

- A not so attractive reality according to the EBA: Another sound of bell is held by the EBA (European Banking Association) which underlines that France is rather in the tail for the enrolment of a means SCA in conformity with the users compared to its Swedish, Croatian, Polish or Belgian neighbors, which reached the objective of the 100% of secure transactions. Moreover, France allows issuers to propose the reinforced SMS as a transitional measure before providing the customer with a fully RT/DS2 compliant solution that ensures the confidentiality of authentication codes.

MARKET PERSPECTIVE

- While the Banque de France Observatory emphasizes the positive aspects of its study, the fact remains that the payment market in France still requires some improvements.

- UFC-Que Choisir emphasizes that the amount of payment fraud is still too high. 1.28 billion euros were thus defrauded from the French in 2020 following the embezzlement or theft of a check, the fraudulent use of a bank card or a transfer issued without consent (+8.4% compared to 2019).

- Bank card hijackings still account for a large majority (97%) of the number of fraudulent transactions, with two-thirds validated online.

- 80% of the strong authentication methods currently used by the French also include a so-called "reinforced SMS" solution, which could be challenged by the European Banking Authority (EBA) in terms of RTS/DSP2 compliance.

- The risks remain significant; according to a study by Juniper Research, losses due to online payment fraud will exceed $206 billion worldwide between 2021 and 2025.