Atoa, UK payment fintech A2A raises €2.1m

Atoa Payments is a UK start-up that uses open banking to offer merchants an alternative to card payments. It raised $2.2 million in a pre-seed funding round.

FACTS

-

The round was led by Leo Capital and Passion Capital, with participation from angel investors such as GoCardless and Nested co-founder Matt Robinson, Moon Capital Ventures and MarketFinance co-founder Anil Stocker.

-

Atoa founders Sid Narayanan, Cian O'Dowd and Arun Rajkumar come from Singapore where they were used to using alternative payment solutions. The UK's open banking infrastructure seemed like an opportunity to create an alternative to card payments.

-

Mastercard and Visa payment rails can cost small merchants and their customers net margins of 51%, with fees of 1.5 to 2% on each transaction.

-

In response, Atoa charges between 0.6% and 0.3% per transaction. It also has no equipment rental, service fees or PCI certification compliance fees.

-

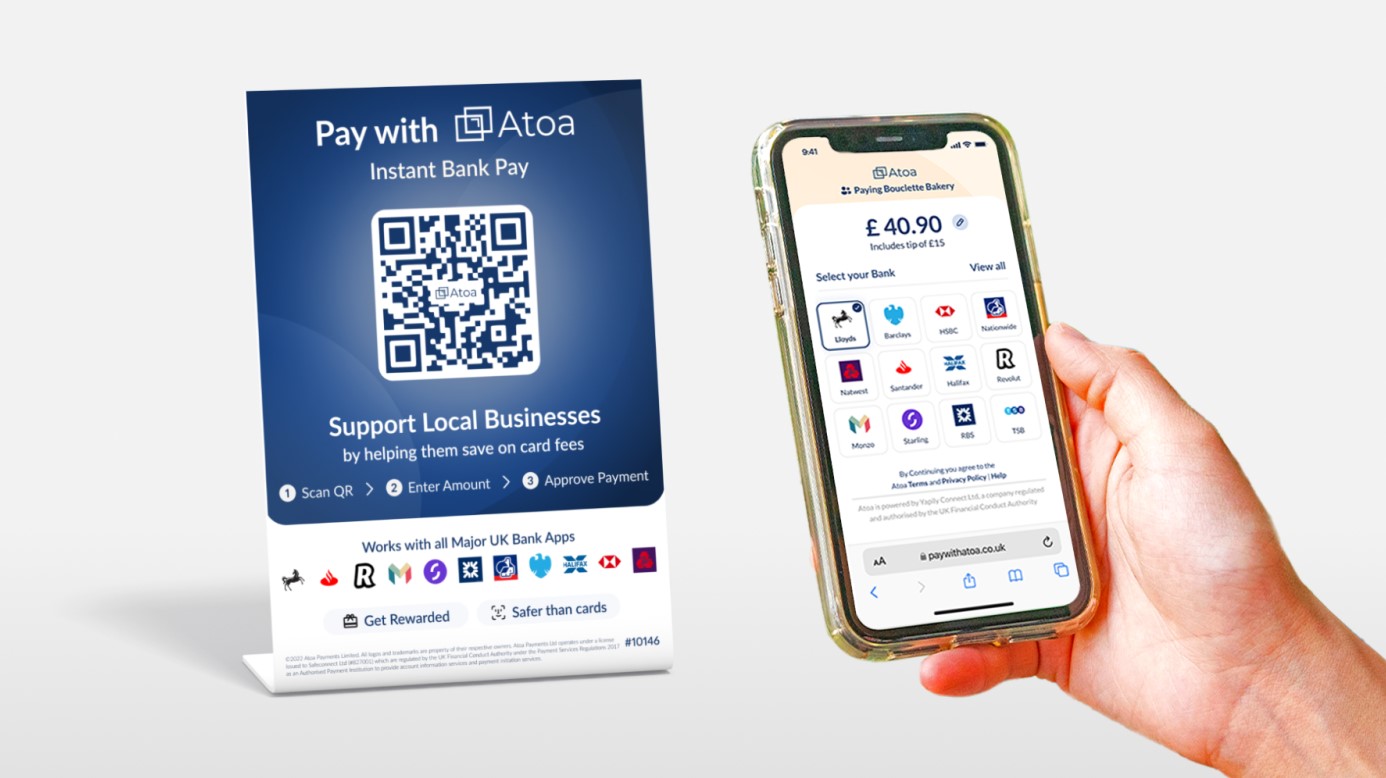

Customer journey:

-

Customers scan the QR code or click on the payment link sent by the merchant;

-

They select their bank;

-

They are then redirected to their banking application to approve the payment.

-

-

Atoa's technology uses a payment initiation API to connect the application to the merchant's bank account to issue a payment instruction.

-

To encourage more customers to use Atoa, the startup also plans to add loyalty rewards and benefits, such as digital scratch cards that can earn cash rewards in their existing UK bank accounts.

-

Once customers pay with Atoa, merchants receive payment instantly via Instant Bank Pay. They also receive funds in their bank account immediately, instead of waiting up to 1-2 working days.

CHALLENGES

-

Reducing costs: Atoa has entered the UK market at the right time to take advantage of open banking and provide small and medium-sized merchants with a solution that allows them to reduce the costs associated with accepting payments.

-

Ease of use: The question is whether consumers will accept this new form of payment. Paying by card is such an ingrained habit that some customers may not like being asked to pay in a different way. According to Narayanan, the majority of adults, around 80% in the UK, already have a mobile banking app on their phone, removing the main source of friction. Merchants simply send a payment link via SMS, PayBay or offer a QR code to scan.

-

Reassurance: In all cases, the fintech never touches its customers' money. It simply asks the customer's bank to transfer the money to the merchant.

MARKET PERSPECTIVE

-

Atoa is obviously not the only fintech to enter this market, nor is it the first. But this fundraising in a rather gloomy period confirms the relevance of this trend.

-

The UK is the favourite destination for fintechs to implement open banking payment solutions. The UK is a favourite destination for fintechs to implement open banking payment solutions, such as Volt, a start-up that transforms card payments into transfers using its Transformer payment gateway, or the Scottish bank TSB, which allows its customers to make transfer payments via the whatsapp channel using Bankifi's open banking technology.

-

In the United States, the Pay by Bank standard is also attracting interest from banks such as Bank of America, which is banking on the solution of the startup Banked, which aims to become the leader in alternative online payment methods.