Atoa to promote Pay-by-bank payments

UK-based Irish fintech Atoa has closed a $6.5 million seed funding round led by Valar Ventures, a US fund backed by PayPal and Facebook's first investor, Peter Thiel. Valar Ventures has already backed fintechs such as Wise, Xero and N26 in Europe.

FACTS

-

Atoa aims to make card payments accepted by SME merchants using account-by-account payments

-

By enabling customers to pay in-store via instant bank transfer, merchants can avoid 1-2% transaction fees

-

Consumers don't need to download any additional apps and can approve payments via their existing banking app, which 80% of UK consumers have.

-

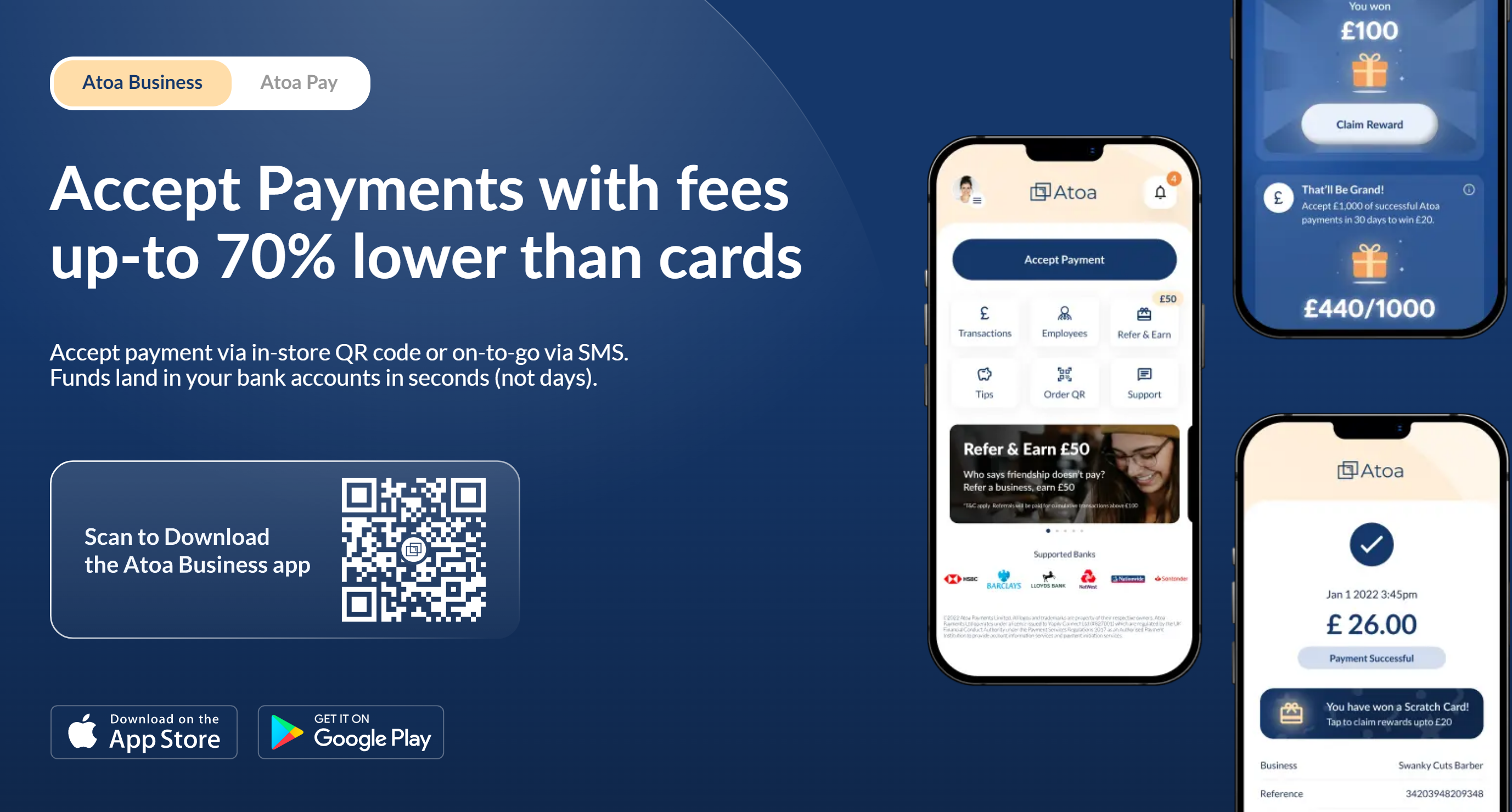

Businesses can download the Atoa app, connect the merchant's bank account and start accepting payments after a 5-minute set-up process.

-

The solution accepts SMS, Pay-by-link or QR code payments in the Atoa app (or on the physical QR holder next to the till).

-

Customers can pay in-store by scanning the merchant's QR code, selecting the account from which to pay and authorizing the amount.

-

The company recorded a 60% increase in monthly payments processed, and the seed round brought the company's total funding to $8.6 million.

CHALLENGES

-

Avoid Visa and Mastercard commision fees: the solution avoids Visa and Mastercard fees, which account for 98% of the UK's £850 billion debit card transactions.

-

Offer instant transfers for real-time merchant cash flow: as payment is an instant transfer from account to account, it enables merchants to manage their cash flow in real time.

-

Lower the cost of payments, which had been on an upward trend since 2016: the Coalition for the Digital Economy (COADEC) estimates that payment costs have risen by 44% since 2016.

MARKET PERSPECTIVE

-

Atoa's previous investors include backers Monzo and Tide, Passiona Capital and Singapore-based Leo Capital.

-

As a reminder, the European Payments Initiative (EPI), has just officially completed its short-term project and acquisition of two Benelux companies, Payconiq and Currence (the originators of the iDEAL payment solution). These two acquisitions also mark the return of Dutch banks to EPI Company's capital via ABN Amro and Rabobank. Initially conceived as a competitor to Visa and Mastercard, EPI has set itself a new course and acquired the technological resources to develop a truly pan-European payment solution. A test phase is scheduled for the end of the year.

-

French, German, Belgian and Dutch banks are looking to extend their EPI pan-European payment system, while Polish mobile payment system Blik is looking to expand its payment solutions in the euro zone, particularly in France. The news confirms the interest in alternatives to bankcards, but also the fragmentation of the European market, where national solutions have yet to be finalized.