Atlar raises funds to automate B2B payments

Atlar is a Swedish fintech founded by former Tink employees Joel Nordström, Joel Wägmark and Johannes Elgh, who set out on a mission to modernise the sending of B2B payments by providing companies with standardised APIs that allow them to connect to their banks to automatically generate their payments.

FACTS

-

The round was led by Index Ventures, La Famiglia VC and Cocoa VC, with participation from a number of angel investors, including Mikko Salovaara, CFO of Revolut, former Executive Vice President of Global Sales at Adyen, Thijn Lamers and Professor Jan Kemper, CFOs of N26.

-

Atlar is a platform that allows businesses to automate all their payment activities, including initiating transfers, reconciling transactions and processing direct debits, directly with their existing banking partners.

-

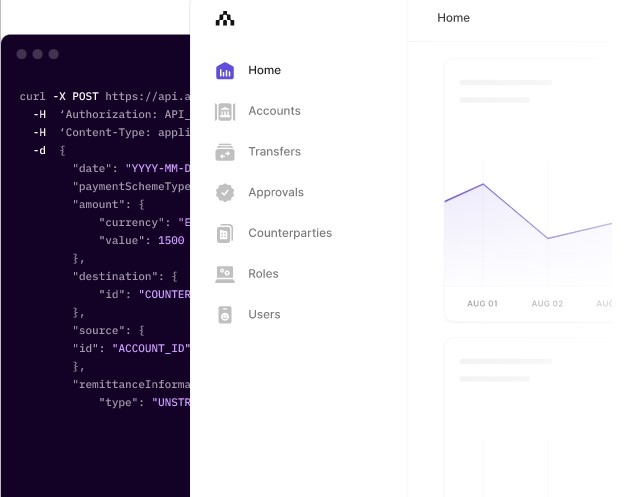

Users can initiate transfers, manage direct debits and access corporate banking data via an API and dashboard.

-

In particular, Atlar can be used for insurance premium payments, loan repayments, or transactions involving multiple bank accounts in multiple European countries.

-

Atlar has already integrated a number of early customers into its platform, including insurance company Lassie, payment company Mynt and German financial technology lender Banxware.

CHALLENGES

-

Addressing a need that is still poorly covered: While the recovery and exploitation of open banking data was the focus of a first wave of fintechs, of which there are now many on the market, and other fintechs such as the Dutch company Adyen focus on automating the acceptance of payments, Atlar's platform positions itself on the automation of the initiation of payments between companies, a service that is, according to the fintech, still relatively unaddressed and carried out manually in many companies.

-

Exploiting a technology of the future: Applications based on programming interfaces, otherwise known as APIs, are making it possible to automate an increasing number of financial operations in an increasingly subtle manner. Atlar is initially focusing on the initiation of payments from bank accounts, but in the future it could add a number of options, such as the deferred payment that is so popular with companies. Atlar's platform therefore has a lot to offer its investors and customers. Its founders want to make Atlar the operating system for bank payments.

MARKET PERSPECTIVE

-

Another fintech caught our attention last January when it launched a similar service for automating bank transfers for companies. This fintech called Numeral managed to raise €13 million and gather around its project prestigious investment funds such as Balderton Capital and Kima Ventures, as well as investors such as Alexandre Prot (Qonto), Tom Blomfield (Monzo), Guillaume Princen (Stripe).

-

B2B payments are attracting more and more attention, whether from investors, who are funding fintechs such as Fintecture, which offer dedicated services to businesses, banking groups such as BNP Paribas, which by acquiring the fintech Kantox wants to improve its own offerings dedicated to this segment, and even e-commerce players such as Amazon, which is competing with banking players to facilitate the cash management of their customers.