A Real-Estate Website Featuring Financial Services

FACTS

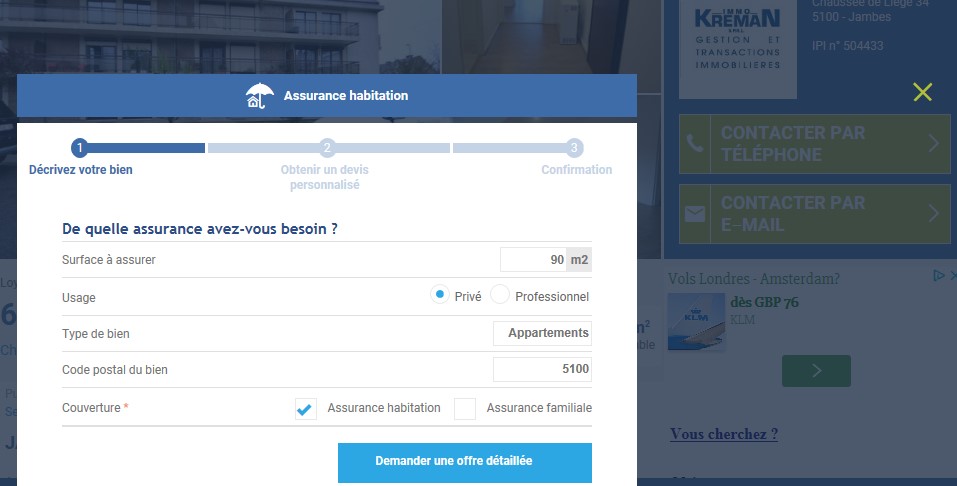

- Immoweb –well-established Belgian property advertisement website– diversifies their set of services through the addition of financial services. They team up with an innovative insurance player to introduce a Blockchain-based contract.

- New features:

- Mortgage broker,

- Insurance broker.

- Immoweb founded a new company, Immoweb Financial Services, subsidiary they fully own and assigned €3M capital.

- Along with this strategic repositioning, they also launch an innovative Blockchain-based insurance contract.

- This digital offer is meant for tenants and can be subscribed online or at one of Immoweb’s partner branches. They ensure automation for part of the contractual process and improved information services for the insured parties. Since it is powered by a Blockchain, damage claims and other files can be timestamped, information can be stored securely, avoiding potential fraud attempts.

- The offer was designed by La Bâloise, the InsurTech Qover and Axel Springer group (parent company of Immoweb).

90% of Belgian tenants have a home insurance.

50% don’t know the name of their insurance company or what their contract covers.

Source: Immoweb, 2019 study

CHALLENGES

- Expand their range of offers using real-estate transactions. In addition to insurance offers, Immoweb plans to roll out financial services. The group just applied for their subsidiary to be approved by the FSMA. They would also be considering the addition of mortgage financing at a later point.

- Building on their partnership with Qover. A few months ago, Immoweb launched a guarantee against unpaid rents for owners on their platform. This product appears to have been successful so far, leading the website to look further into financial services with an insurance service for tenants.

MARKET PERSPECTIVE

- The InsurTech Qover already made their flexible service infrastructure available to La Bâloise as white label. They also launched a BtoC product (a travel insurance).

- This tripartite agreement involving Immoweb is fairly representative of new partnerships between industry players and the disruption of boundaries between markets for the sake of a universal platform-based model. This dissolution is supported by the PSD2 and inspires players beyond the banking industry.