A Mobile Bank for Developing Countries Raising Funds

FACTS

- FairMoney, mobile bank aiming for emerging countries, just announced a funding Series.

- The French-Nigerian FinTech FairMoney raised €10 million form Flourish Ventures, DST Global partners and existing partners (Newfund, Speedinvest and Le Studio VC).

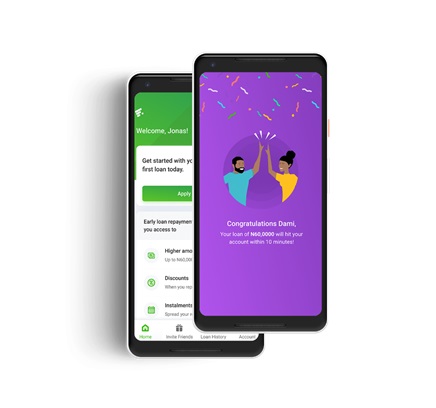

- FairMoney built a microcredit app based on analysing customers’ Smartphone data for granting loans up to €400.

- This start-up relies on an in-house algorithm and Machine Learning technologies to assess applicants’ creditworthiness.

KEY FIGURES

- 2017: FairMoney was founded

- 45 employees

- €15M total raised

- +200,000 customers

- 350,000 credits granted or €15M

- Interest rates: 10 to 25%

- 60% of loans granted to afford business needs

- Average amount lent: €30

CHALLENGES

- Sparking attention globally. With this Series, FairMoney gets funding from Flourish Venture. This American VC (created by eBay’s founder) is completing their first investment in a French start-up.

- Solving infrastructural issues. FairMoney targets emerging markets poorly addressed by long-standing banking institutions. They deem that over 2 billion people worldwide have limited access to banking services.

- Diversifying their range of offers. FairMoney intends to rely on this funding round to expand their set of services into a full-fledged banking offer, including credit and payment solutions, a mobile wallet, checking account, savings and money transfer options.

MARKET PERSPECTIVE

- FairMoney also launched an app for recurring payments (e.g.: phone and electricity bills) and reports more than 400 payments daily.

- Besides Nigeria and neighbouring countries, FairMoney plans to aim for more countries, including in South Asia, for instance.

- FairMoney hopes they can attract 300,000 additional customers by end-2020 and achieve the 2 million users’ milestone in two years. They also want to increase their workforce to be hiring 100 to 120 people by end-2020.