Worldline presents account-to-account payment service

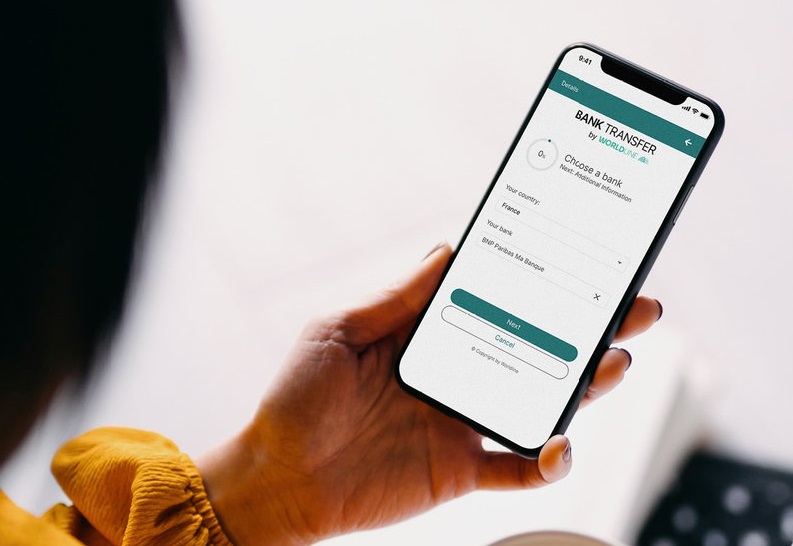

The global payment giant Worldline recently presented its account payment method called "Bank Transfer by Worldline". Addressed to traders, the solution will allow them to accept account-to-account payments in 14 European countries by the end of 2024. This launch represents a way for Worldline to get involved in the growing trend of rollout of Account to Account solutions.

FACTS

- The Bank Transfer by Worldline service will therefore allow traders to accept payments from approximately 300 million eligible customers, i.e. those with an account with the European Bank, based in the 14 countries covered.

- Bank Transfer by Worldline is now available for traders in 10 European countries: Austria, Belgium, Croatia, France, Germany, Italy, Luxembourg, the Netherlands, Slovenia and Spain.

- The solution will be more widely proposed in four other countries by the end of the year, in Poland, Slovakia, the Czech Republic and Hungary.

- "Bank Transfer by Worldline" is also integrated into the online payment solutions and invoice payments (via an online link) of some 500 Worldline customers. It is specifically targeted at companies managing large transactions, namely:

- Specialized traders;

- Public sector enterprises;

- Companies operating B2B payments.

- Promising simplified integration, the device complements practical features such as instant notification, refund management, financial steering and accounting.

CHALLENGES

- Tested and approved: The Bank Transfer by Worldline service has been tested by Worldline in countries currently covered over the past nine months. Bank Transfer by Worldline also integrates Worldline's Open Banking solution, connected to more than 3,500 banks in European countries.

- Simplifying payment: "Bank Transfer by Worldline" offers traders a solution promising to simplify the initiation of payments by bank transfer and to unify the customer experience. A promise that Worldline wishes to make across Europe to maximize its impact on its market.

MARKET PERSPECTIVE

- The launch of this new service by Worldline represents a way for the payment specialist to find new revenue opportunities and to follow a trend already well started by other players in the payment market.

- Nexi and MasterCard, Plaid, Visa, Klarna and Adyen and Tink are all actors already positioned on the theme. Worldline's positioning demonstrates the growing interest of this market, including for historical players.