With iOS 16, Apple breaks away from banks and unveils a "Pay Later" option

As signals to the contrary began to cloud the previously enthusiastic predictions of the Buy Now Pay Later market, Apple entered the market with the release of the latest version of its mobile operating system iOS. Apple had announced its intention to offer its own fractional payment service and, more generally, to further develop its payment services. This intention is now taking shape again, but it also marks a strategic shift on the part of Apple, which is breaking away from the banks to impose Apple Financing.

FACTS

-

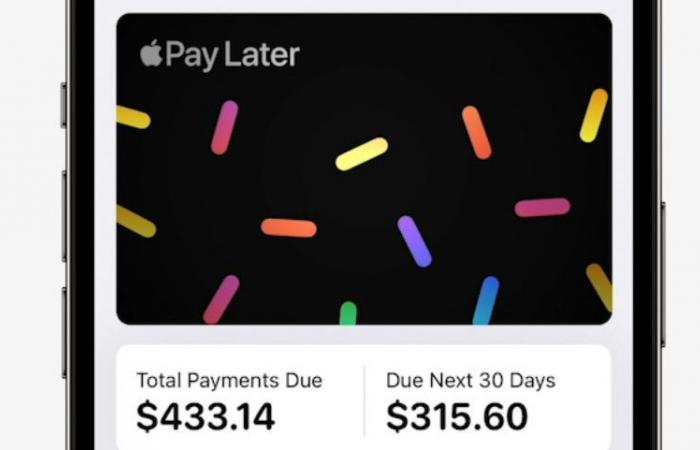

With Apple Pay Later, it is now possible to make a payment in four instalments without charge, spread over six weeks.

-

To optimise budget management, the application allows you to see the amounts remaining to be paid, as well as the payment schedule.

-

Powered by Mastercard's Installment solution, Apple Pay Later is available wherever Apple Pay is available in the US, both in apps and on the web.

-

Apple Pay Later is part of Apple's iOS 16 iPhone software update which, if it follows Apple's typical release cycle, will arrive in mid-September.

-

This is not the only update coming to Apple Pay, as earlier this year it unveiled 'Tap to Pay'. To make it easier for individuals (but also SMEs) to make transactions, Apple is now offering payment via Apple Pay directly from one iPhone to another.

CHALLENGES

-

Accelerating the development of its payment functionalities, to enrich the Apple wallet, which is becoming a central element of the Apple brand's ecosystem of services: Apple has reportedly been working with Goldman Sachs for a long time on a "pay later" service, and the technology giant's decision to acquire British fintech Credit Kudos in March was also reportedly linked to its plans to quickly launch its BNPL service. But where Apple is surprising is precisely in its choice not to let Goldman Sachs manage these loans. With Apple Financing, a dedicated subsidiary with the necessary equity, Apple is making its first autonomous move into financial services and is taking charge of customer scoring, drawing on the expertise it acquired when it bought Credit Kudos.

-

An untimely launch: This launch is likely to be another blow to Klarna and Affirm, both of which have had a difficult few months with falling share prices and recent redundancies. However, Apple is likely to face the same challenges as its competitors, starting with the forthcoming tightening of regulations. Apple is also reportedly considering offering credit (Pay monthly), this time with banking partnerships (Goldman Sachs?).

MARKET PERSPECTIVE

-

The BNPL remains incredibly popular among American consumers. More than 51% of Americans reported using a BNPL service in March 2021, according to a survey. And Accenture estimates that the number of BNPL users in the US has reached 45 million by 2021.

-

But BNPL products are coming under increasing scrutiny from regulators, some of whom argue that the BNPL business model is unnecessarily risky. In a survey last year by Credit Karma, more than a third of respondents who had taken advantage of BNPL-style finance schemes said they had fallen behind on their repayments.