Visa partners with Plan A to help businesses calculate their carbon footprint

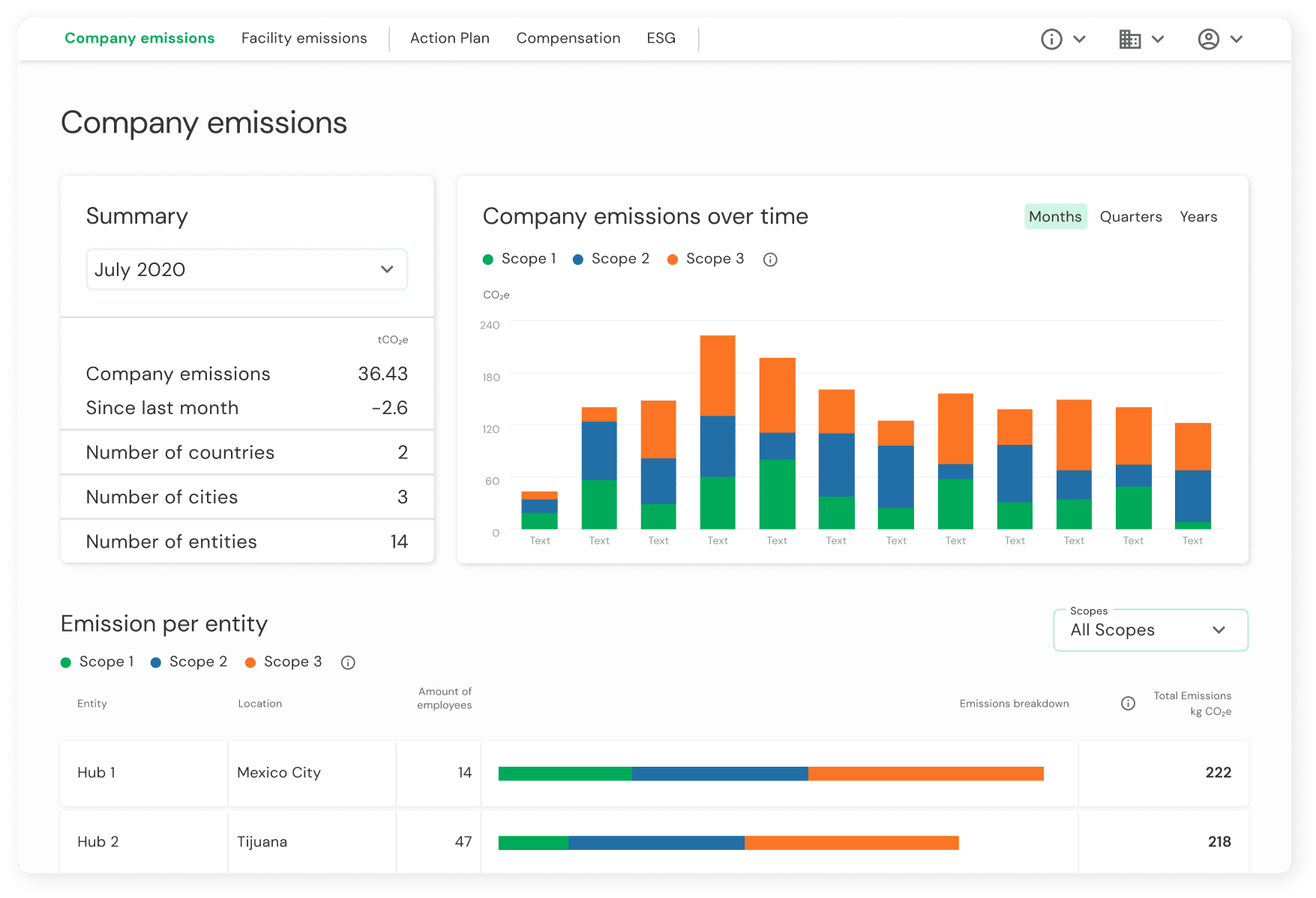

Visa will offer its clients the Plan A platform for calculating Scope 1, 2 and 3 emissions as part of its Fintech Partnership Connect programme.

FACTS

-

Plan A is a Franco-German sustainability and ESG criteria mapping platform created in 2017.

-

By automatically mapping all necessary data for Scope 1, 2 and 3 and combining it with emission factors, the software is able to create individual emission profiles and provide granular carbon and ESG information in tables across companies.

-

Plan A's sustainability platform enables companies to drive their "Net Zero" trajectory and reduce their carbon emissions by at least 5% per year and up to 50% over 10 years.

-

The partnership with Visa will accelerate Plan A's mission to measure and reduce 1 gigatonne of CO2e per year.

-

Under the terms of the partnership, Visa will provide Plan A's sustainability platform with a state-of-the-art SaaS solution as part of its Fintech Partner Connect programme.

-

The scientific accuracy of the Corporate Carbon Footprint (CCF) methodology is certified by TÜV Rheinland, one of the world's leading verification bodies.

-

Plan A's clients include N26, BNP Paribas, ApaxPartners, Albion Capital, Sorare, BMW, Trivago, Société Générale, Payhawk and the European Union.

CHALLENGES

-

Outsource and automate ESG activity: With the high degree of automation of the sustainability journey within the Plan A platform, decarbonisation and ESG reporting becomes highly scalable, time and cost efficient, and frictionless.

-

Hedging the financialisation of environmental risk: In the coming months, new regulations will turn climate risk into financial risk for companies. In July 2022, the Minister for Energy Transition signed a decree extending the scope of companies subject to BEGES (Bilan des émissions des gazs à effets de serre) reporting. Failure to draw up or transmit the BEGES will be punishable by a fine of 10,000 euros, compared to 1,500 euros previously.

MARKET PERSPECTIVE

-

After carbon calculators for individuals, carbon monitoring is attracting more and more players in fintech and elsewhere.

-

A French start-up has also entered this niche. It is called Sami and deploys its climate expertise through its technological platform and individual support to more than 400 clients interested in measuring and reducing their CO2 emissions. It announced a fundraising in an unusual format, bringing together 272 investors and no private equity funds.

-

On another topic, Visa announced at the US-Africa Business Forum its commitment to 'invest $1 billion in Africa over the next five years to advance resilient, innovative and inclusive economies on the continent.