Visa helps banks deploy cryptoassets

U.S. payment giant Visa is continuing its efforts to establish itself as a benchmark for payment beyond the card. To this end, it has launched a new platform called Visa Tokenized Asset Platform (VTAP). Its positioning is clear: the platform is placed at the service of banks to help them issue fiat currencies on the blockchain. An initial partnership has already been signed.

FACTS

-

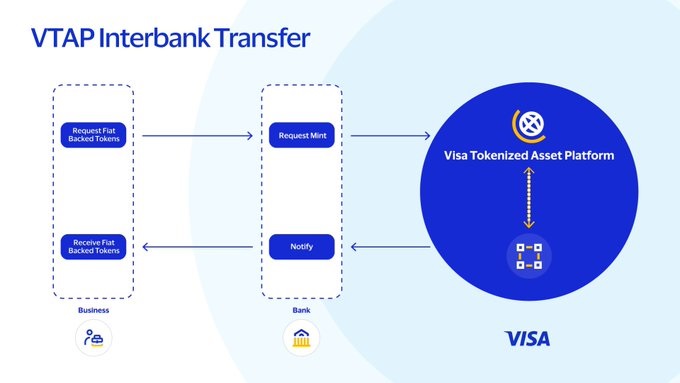

The new Visa Tokenized Asset Platform (VTAP) was presented by Visa. The platform will enable banks to issue tokens backed by fiat currencies (stablecoin), on the public Ethereum blockchain.

-

BBVA is the first bank to be associated with this project.

-

The Visa Tokenized Asset Platform (VTAP) is available on the Visa Developer Platform. Participating banks can access VTAP services via APIs. The platform is also associated with a sandbox that will enable banks to :

-

Create and test their own MNBCs;

-

Use stablecoins as part of smart contracts;

-

Administer and automate processes involving payment (e.g. management of credit lines and conditional release of funds, purchases of commodities or tokenized treasury bills).

-

-

The Visa Tokenized Asset Platform (VTAP) will be deployed in pilot projects scheduled for 2025. End customers will then be involved, once the test banks are ready.

CHALLENGES

-

Helping traditional players: The Visa Tokenized Asset Platform (VTAP) is presented as a turnkey BtoB product designed to help financial institutions position themselves on blockchain networks.

-

Setting the standard: With the Visa Tokenized Asset Platform (VTAP), Visa is helping to link existing fiat currencies to blockchains, thereby establishing itself as a key player in the management of digital exchanges for MNBCs.

-

Mastering an interoperable environment: MNBC adoption also depends on the interoperability of solutions. Visa is capitalizing on its position as a payment reference to offer banks an environment enabling interoperability between different blockchains.

MARKET PERSPECTIVE

-

Visa also highlights its position as a global network serving over 15,000 financial institutions. While it currently helps to facilitate fiat currency transactions in over 200 countries and territories, it is now looking to transpose its expertise to Blockchain networks.

-

This is not the payment giant's first initiative in this area. Last January, it unveiled its Web3 customer loyalty platform to revolutionize customer engagement. Already, in September 2023, Visa wanted to accelerate cross-border payments with stablecoins.