Upturn Helps US Customers Spot Scoring Inaccuracies and File Claims

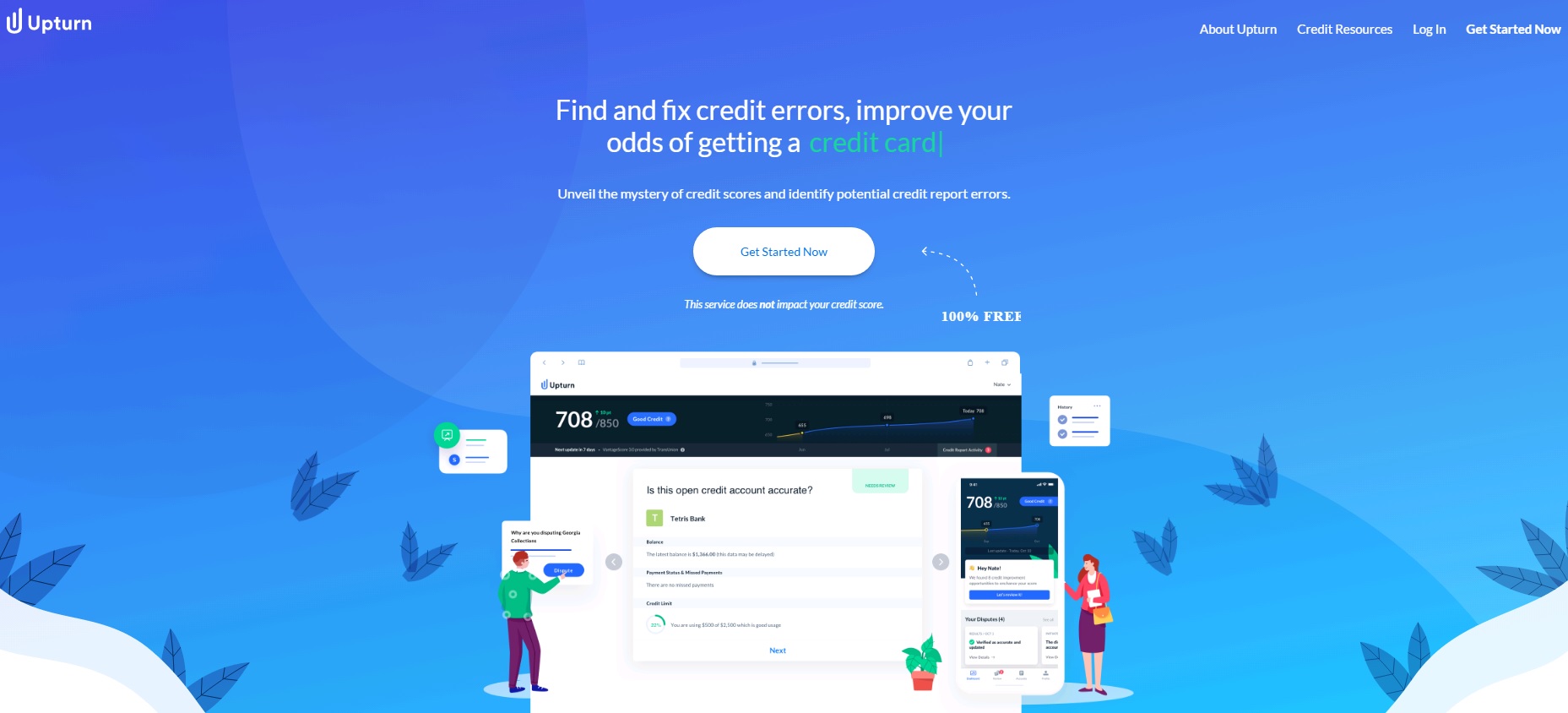

Upturn, a US startup incubated by BBVA, crafted a free online platform enabling US customers to identify inaccuracies in their credit report data and file claims. This process allows them to better monitor their data, making it easier to access credit offers.

In the US, 22 million people are denied access to credit facilities every year due to mistakes in their credit files. According to the Federal Trade Commission, nearly 25% of the credit reports are inaccurate. Upturn built an online portal enabling consumers to track their credit history and make sure their file is properly updated.

Customers have to provide some pieces of information when logging on to this portal (name, e-mail, password). Upon setting up an account, they acknowledge that data to do with their creditworthiness will regularly be retrieved by Upturn from credit scoring agencies. This data is required to improve their credit file: registering to this platform does not have a negative impact on their credit score.

The current identification system is particularly complex. This new service makes it possible for customers to rely on a free tool to potentially file claims and improve their credit history. Financial Players, on their part, are sure to be in contact with creditworthy consumers, wrongly forbidden to apply for credit offers.

Comments – Helping consumers monitor their credit score

Upturn was created by BBVA in 2017, they were incubated in one of the bank’s units for supporting research and growing FinTechs. The same year, BBVA paid special attention to online identity protection (with Covault), SMEs-oriented banking services (with Azlo), and instant transfers (with Tuyyo).

With Upturn, they bet on a transparent approach to credit-granting processes in a country where there are over 250 million credit files, including 10% that might need to be qualified again. They provide consumers with access to their own scoring informations –as does Credit Karma. BBVA has long been valuing customer data, and again shows that this valuation first relies on communicating with their customers. Other companies opted for similar strategies: AXA in the insurance sector, and ABN Amro in partnership with Ockto, for instance.