The new ecological bank Only One in liquidation

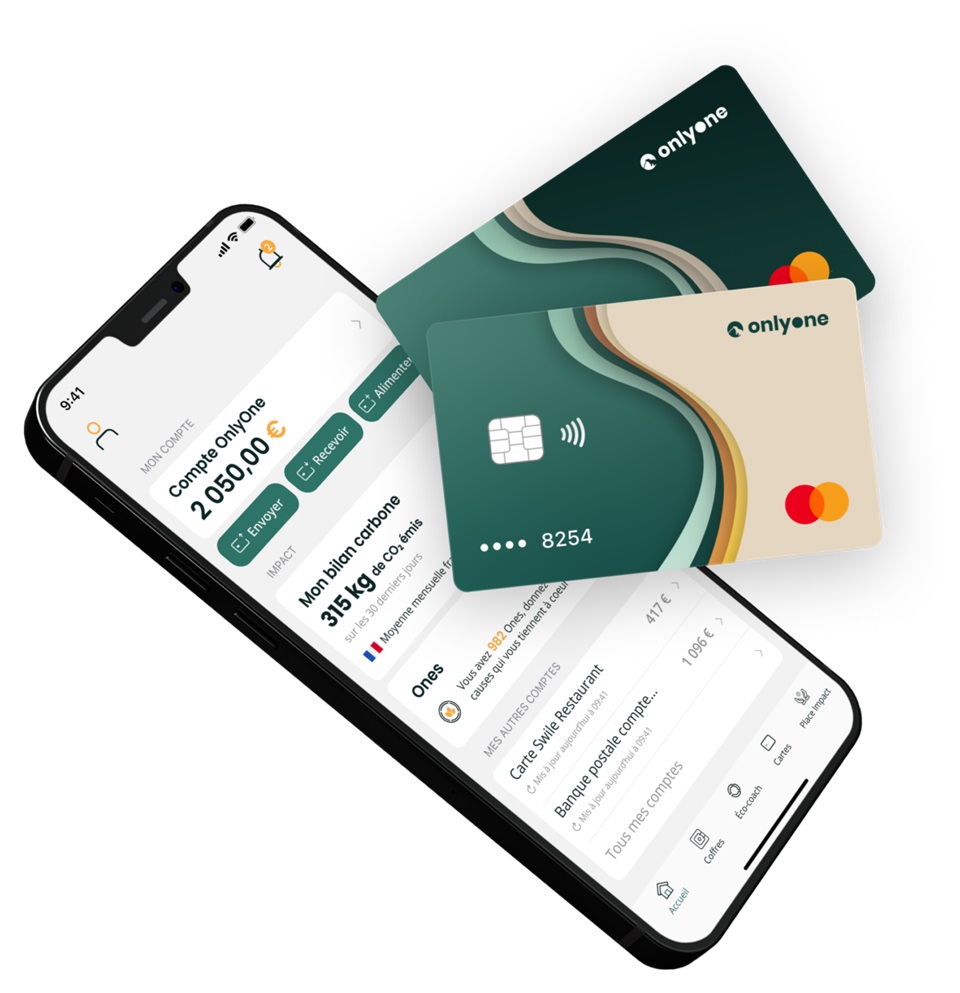

The neo-bank Only One Defended ecological ambitions to differentiate in the rich French alternative financial services market since the official presentation of its offer in October 2020. But its efforts to sustain its model, including by opting for a BtoB diversification of its offer, would ultimately not have allowed the neo-bank to continue its activities.

FACTS

- The company's Infogreffe page Only One now refers to an ongoing proceedings before the Paris Commercial Court concerning the company on February 12.

- This judgement will have sealed the fate of the neo-bank that was placed in liquidation. It had also declared that it had ceased payments on 29 January 2025 to the Paris Economic Court.

- This is a direct result of an investor's disengagement, lack of financing and FinTech's difficulties in demonstrating the effectiveness of its business model.

- OnlyOne worked with the Banking-as-a-Service platform Treezor to operate its services.

ISSUES

- Fight against competition : In France, other environmentally responsible financial services were already available on the market. Helios and Green-Got This continued while Only One, which hoped to have 10,000 users for its services by the end of 2021, claimed 3,000 registered at the top of its business by the end of 2022. It would leave almost 700 specific customers without service at the moment.

- Difficult diversification : After launching its service to individuals, Only One chose to diversify its activities by also addressing professionals with an offer named Only One for Business. This offer, which was expected to be deployed during 2025, was launched as part of a beta test phase in the first half of 2024. Some 20 companies were then engaged, according to the statements collected by Mind FinTech from Kamel Nait-Outaleb, co-founder and president of OnlyOne. Almost 350 companies had also registered on a waiting list.

PERSPECTIVE

- The judicial liquidation of OnlyOne highlights today and once again the difficulties currently facing startups and Fintechs in securing the financing of their business. To try to pull their pin from the game, Helios as Green-Got Just a few days ago, made the choice to launch a premium pay offer in order to at least partially profitable their model.

- A key strategic positioning while the financing market for FinTechs in France has slowed sharply in recent months. One study was carried out on the topic by the Fintech Observatory in partnership with KPMG, MasterCard and the trading platform eToro. Its results, published at the end of 2024, showed an increase in fund-raising of 20% compared to the particularly morose year of 2023. The French Fintech raised a total of €1.3 billion in 2024.

- But if this figure were boosted by two major operations involving Alan and Akur8, the number of financing operations recorded is decreasing, rising to 92 in 2024 from 140 in 2023. It thus illustrates a more complicated funding effort for a majority of Fintech today.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate