Tesco Bank Starts to Favour a Mobile Approach

Tesco Bank, fully owned by the UK number 1 retailer Tesco, introduces “Native mobile registration” making it simpler for banking customers to use their mobile app. This service lets them configure and connect to their account directly from their smartphone. They also can access different banking services, and credit cards-related features. This new set of services should meet consumers’ needs and growing expectations when it comes to next-generation technologies and mobility.

Roughly one million Tesco Bank customers are using their mobile app. This service incorporates all core banking services. Yet, customers would have to set-up an account and go through the identification process on Tescobank.com to be able to access it. By way of improving browsing and interactions Tesco Bank is adding new mobile features.

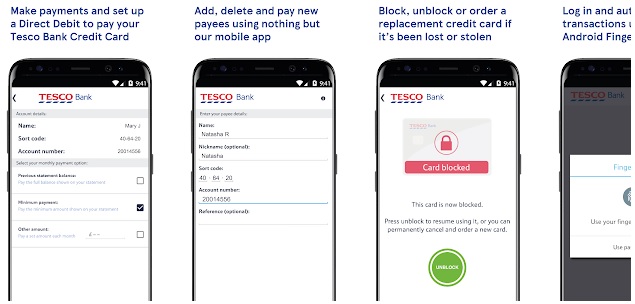

The new app version relies on “Native mobile registration” technology, enabling customers to access more features entirely from their smartphone: biometric authentication (via Face ID and Touch ID), credit card blocking/unblocking, faster account balance consultation, monthly credit card repayments via direct debit, credit card scanning for storage (as with Apple Pay), etc.

This development is a technological leap and security-wise advancement for a long-standing player. It is a way for them to become part of the –extended– circle of players whose “Mobile First” approach prevails.

Comments – Tesco Bank takes the “Mobile First” turn

Tesco Bank initially proposed in-store credit offers mainly, and mobile services were only secondary. Yet, as they paid increasing attention to the way their customers behave, they started to focus on a “Mobile First” strategy, too.

Several banking players have already decided to favour a mobile approach since customers’ interactions tend to evolve fast: in France, BNP Paribas for instance relies on their subsidiary Hello Bank!; and, in the US, Citi just completed an outstanding strategic shift with a mobile app available for all (including non-customers). This app acts as an account aggregation offer likely to take over all their other banking channels. This choice bears a risk not all players are ready to take just yet. Some financial companies designed their own mobile bank (Orange Bank). Evolving use cases have been leading banks to make adjustments to their offers so they can be accessed faster, encompass various services and be user-friendly.