SumUp internationalizes its credit offer

British FinTech SumUp, which specializes in payment acceptance and the deployment of collection services, is determined to consolidate its position in its market and beyond. Having recently underlined its sound financial health, the company is now announcing its intention to diversify internationally. Its credit offer, hitherto limited to the UK market, is now being rolled out more widely across Europe.

FACTS

-

SumUp is primarily a digital payments solution offering payment and financial management terminals, as well as a free Pro account.

But since 2020, SumUp has also been offering a cash advance service in the UK. This is presented to SumUp's business customers as flexible, fast and transparent. -

In fact, it is based on a cash advance model of up to €20,000. SumUp specifies that requests can be submitted simply and without red tape, via the service's mobile application and its dedicated account management space.

-

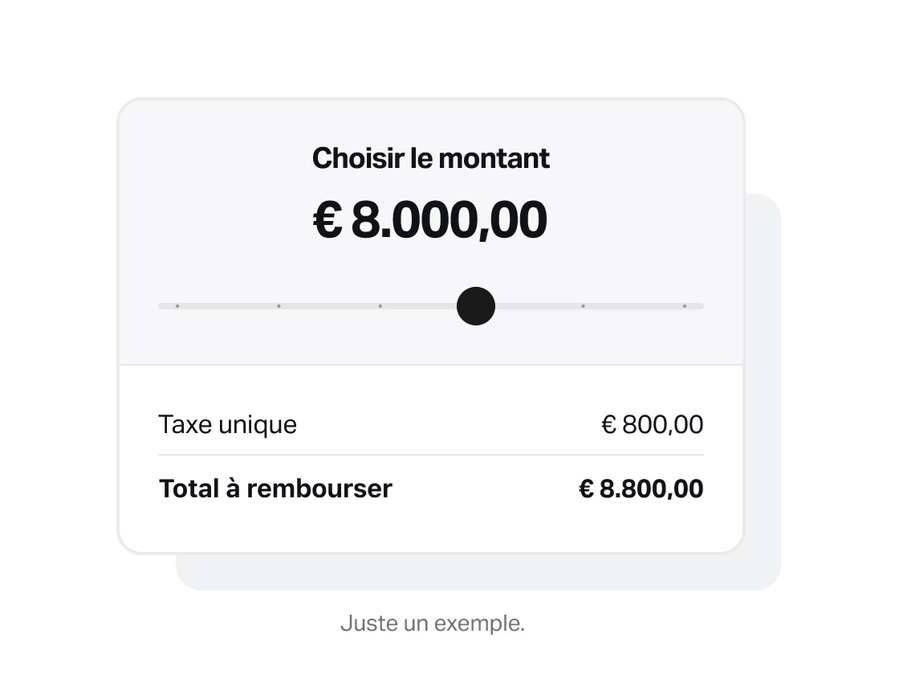

Users can enter the amount they wish to be advanced, up to a personalized ceiling based on an analysis of their sales via SumUp. A fixed commission is applied, with no additional fees or interest. Funds are released within 2-3 days to the bank account used in connection with SumUp.

-

For reimbursement, SumUp automatically deducts a set percentage from card sales collected via SumUp devices, until reimbursement is made.

-

In addition to the UK, SumUp Cash Advance will now also be offered to SumUp business customers in Germany, France, Ireland and the Netherlands.

-

SumUp is collaborating with YouLend, presented as a world leader in integrated financing, to offer its new service particularly in France and Germany.

CHALLENGES

-

Opening up its market and meeting needs more widely: In the UK, SumUp boasts that it has already granted over 100 million euros in financing since launching the service. Not content with satisfying the needs of its customers in its home market, SumUp is now building on its local success to roll out an offering that it believes will also find an audience more widely across Europe.

-

Realizing ambitions: The deployment of SumUp's Cash Advance service had been anticipated for several months. Indeed, in August 2023, SumUp raised a new round of financing to ensure the wider deployment of its service in Europe. At the time, SumUp believed it could capitalize on the knowledge of its customer flows to complete its offer with a credit option.

MARKET PERSPECTIVE

-

SumUp is rolling out this service after underlining its excellent financial health. The FinTech boasts more than one billion annual transactions and record growth.

-

In particular, SumUp currently has over one million customers using its Pro Account. It plans to conquer new countries in 2025 to continue its expansion.

-

Finally, SumUp emphasizes that payment is only one part of its business, and that it now sees itself as a super-app that enables business owners to run their business smoothly.