Study: Allianz highlights French expectations for HRM insurance

Allianz Partners highlights its benchmark status of assistance and assurance solutions to justify its ability to offer relevant market analyses. It is in this context in any case that she presents the latest results of her study concerning a specific theme, that of the relationship maintained by the French and their housing insurance. And their expectations are not always in line with real risks.

FACTS

- The new Allianz Partners study was carried out in partnership with Ifop. This survey on "The French and their home insurance" took the form of a survey of 927 household managers in December 2024.

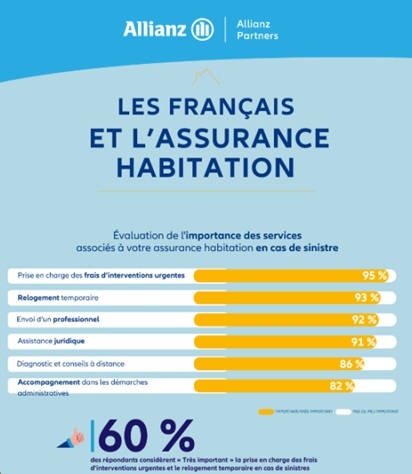

- And his teachings are clear about what the French regard as priorities for home insurance and coverage. Several services are particularly popular:

- Rapid management of emergency response costs (important for 95% of respondents);

- A remote diagnostic and counselling service (important for 86% of respondents);

- Support in administrative procedures (important for 82% of respondents);

- A temporary rehousing solution if necessary (important for 60% of respondents).

- In addition, burglaries, fires and water damage are the most feared disasters by the French. Despite the increase in real risks to climate risks. Allianz notes that only 29% of French people stress that they need extensive protection on this subject for their housing.

ISSUES

- Identifying adaptability needs : Allianz Partners highlights the results of this study as a lever to adapt protection offers to the needs and above all to the real expectations of the French on the theme of HRM insurance.

- Putting real risks in perspective : Allianz Partners stresses, however, that one of the main lessons learned in this study is the mismatch between French expectations and real risks. The insurance group thus highlights the growth of climate risks and their increasing impact on French housing. Widespread coverage to better cover damage related to weather, for example, should be a major damage to households, which is not the case today. Allianz therefore puts forward a necessary information and pedagogy operation to rebalance the expectations of the French with their potential real needs.

PERSPECTIVE

- Allianz Partners states that it has experienced a significant increase in the severity of claims over the last three years. Moreover, this estimate is well underlined by another study recently published by France Insureurs, which puts climate change at the top of the main risks identified by experts.

- In France as in Europe, it is in particular the increase in floods and the cost of these disasters that weigh on the sector. And the forecasts are worrying since, according to France Insureurs, the cost of flooding is expected to be 54 billion euros in France for the period 2020 - 2050. An 87% increase over the previous period.

- However, it is in this context that insurers have chosen to reject the EIOPA (European Insurance and Occupational Pensions Authority) project to develop a pan-European educational tool to raise awareness of climate risks among property owners. The European Insurance Federation prefers a national approach to tailoring discourses to the specific risks of each country.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate