Strong Authentication: Stripe Assisting Merchants

Photo credits: TechCrunch

FACTS

- As the regulation on strong authentication is to come into effect mid-September 2019, and in line with the provisions of the PSD2, the Californian FinTech Stripe introduces two new features for e-merchants. They also announce the acquisition of TouchTech Payments.

- Goals: streamline merchants’ implementation of strong authentication methods.

- Stripe unveils three services:

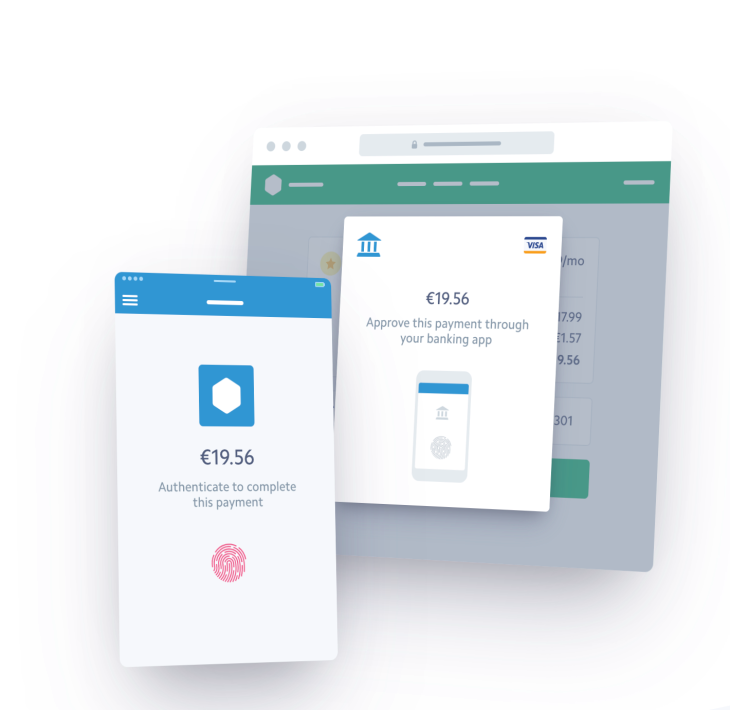

- Payment Intents: an API enabling merchants to build their own checkout experiences while complying with strong authentication requirements. They may include authentication methods such as 3D Secure 2.0, Google Pay or Apple Pay

- Checkout: a payment page adjusted to authentication-related requirements. Companies may implement with just a few lines of code.

- Billing: a set of tools for subscription-based models, making it possible to spot transactions that might require strong authentication and send notifications to the subscribers when additional authentication steps are needed.

- This American unicorn will also feature Strong Customer Authentication guides, e.g.: documentation on SCA-ready APIs, webinars, etc.

- This project comes in addition to their buyout of Touchtech Payments, an Ireland-based start-up focusing on turnkey payment solutions for neo-banking players, FinTechs and financial institutions. The terms of this acquisition haven’t been disclosed.

Only 25% of European e-merchants are aware of the upcoming SCA regulation and of the changes that need to be made

Source: Mastercard study 2019

CHALLENGES

- Educate and assist merchants through the implementation of strong authentication methods. According to some studies, including by Mastercard, this step still isn’t fully understood.

- Address shopping cart abandonment issues. Strong authentication may impact European merchants’ sales figures. In India, a similar regulation came into effect in 2014: conversion rates dropped by roughly 25% for several e-merchants. European merchants will have to make adjustments before September 14, 2019.

- Grasp an opportunity. Just like other PSPs, Stripe intends to make the most of PSD2 implementation on the European e-commerce sector. And, Touchtech Payments could give them a serious competitive edge.

MARKET PERSPECTIVE

- Three months ago, this US e-payment specialist said they intended to further build their international presence and aim for Asia as well as Africa, too. In this case, they are boosting their European reach through their strategic acquisition of TouchTech.

- TouchTech, for its part, will keep designing their offers in Dublin. Their list of rival companies includes Revolut, N26 or even Transferwise. They will rely on Stripe to aim for more targets.