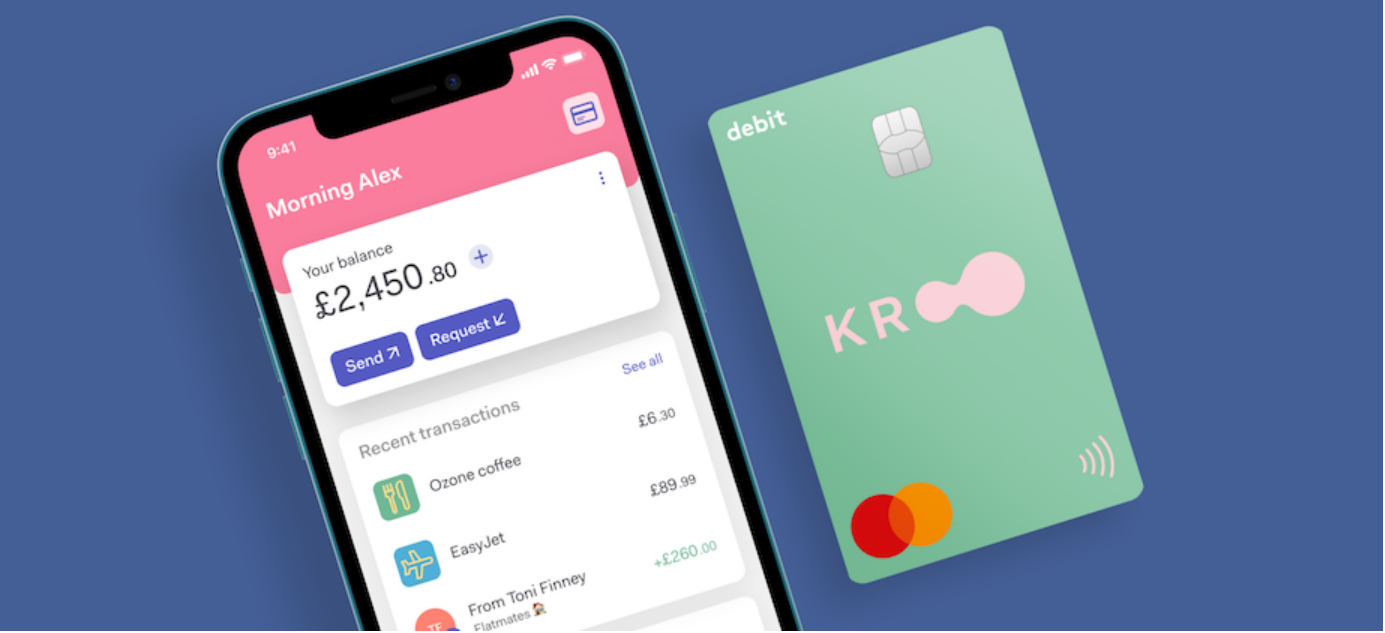

Startup Kroo opens a 2% current account in the UK

Kroo, a UK mobile-only bank, has launched its main user account. It offers customers 2% interest on up to £85,000.

FACTS

-

UK challenger Kroo is launching its current account offer this week, which includes a 2% ISA (up to £85,000).

-

Targeting Generation Y and Generation Z, Kroo claims to plant two trees for every new customer who opens a current account through its charity partner One Tree Planted.

-

Kroo received a full banking licence in the UK earlier this year, becoming the third bank to do so since 2016, allowing it to expand its initial offering of prepaid debit cards and apps.

-

Kroo uses predictive technology to track spending in real time, helping customers make better financial decisions and stay on top of their transactions and upcoming payments.

CHALLENGES

-

Being competitive: the aim of the bank's competitively priced current account is to put money back into customers' pockets through its overdraft and deposit protection services. In the same spirit, international card fees are not charged.

-

Making UK customers' money work for them: analysis of Bank of England data shows that UK households have £271 billion of interest-free debt (30/09/2022). This equates to £5.4 billion lost in interest per year by UK households, which is almost £200 per household.

-

Making an impact in social responsibility: Kroo, with its partner One Tree Planted, is announcing that it will plant two trees for every new customer.

MARKET PERSPECTIVE

-

In 2021, Kroo won the British Bank Awards "Best Newcomer 2021" and the Finder Awards "Banking Innovation Newcomer".

-

In the UK market, we can point to Nationwide offering 5% loan interest, but only on a £1,500 balance. Santander's 123 account is the closest competitor to Kroo, paying 1.75% interest on balances up to £20,000. But it also comes with a £4 monthly fee.

-

In terms of 'social conscience', planting two trees for every account opened certainly means something. However, other banks may have more stringent requirements in this area. Triodos Bank considers itself to be the most socially responsible bank in the UK and promotes the concept of sustainable banking, which it defines as the use of money in a way that takes into account environmental, cultural and social impacts. Triodos customers' money goes to a variety of projects, including charities, community programmes, retirement homes, social housing providers, organic farmers, homelessness programmes and renewable energy.