Samsung Next invests in Curve's solution, future alternative to Apple Pay

The Samsung-owned venture capital fund has made a strategic investment in UK all-in-one card fintech Curve. This announcement follows the pre-launch of Curve's solution on iOS, presented as the first concrete alternative to Apple Pay. Indeed, the coming into force of the Digital Markets Act should force Apple to open up access to its NFC chips to the competition. An opportunity that the fintech has already identified and for which it has already presented its solution.

FACTS

- Samsung Next has announced that it has invested in Curve, for an undisclosed amount.

- The venture capital fund is banking on Curve's ability to compete with Apple Pay thanks to its just-launched Curve Pay wallet.

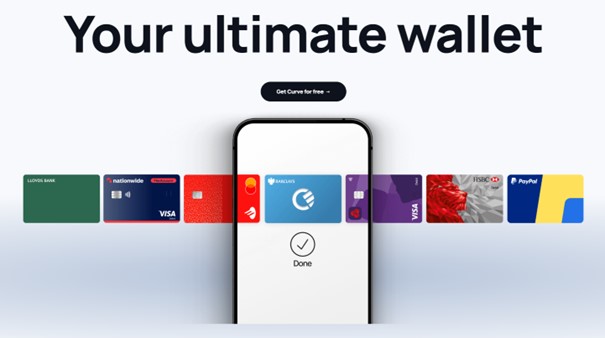

- More broadly, the fintech offers a solution for bringing together multiple cards and bank accounts in a single digital wallet.

- In concrete terms, users enter their debit and credit cards into an application. Once all a customer's accounts are registered, they can manage all their payments on the Curve app. In addition to this, the solution offers several functionalities such as :

- Get Rewards, which lets you combine cashback offers during a payment to benefit from and optimize maximum rewards.

- Go Back In Time, which lets you switch a payment from one card to another up to 30 days after a payment has been made.

- Anti-Embarassment, which activates an emergency card in the event of a first payment refusal.

- As well as other features such as BNPL, instant card lock, no foreign fees, etc.

- All these elements combine to make Curve a unique solution offering consumers centralized management of their payments.

- This functionality was already present on Samsung smartphones thanks to the partnership signed previously between the two companies. It is accessible via Samsung Pay+, which uses the Curve app directly, as well as a Samsung Pay+ payment card.

- The solution can also be used on iOS, but does not benefit from its full potential. Indeed, a user can centralize his cards on the app but is obliged to go through Apple Pay (via a Curve card) to pay with a wallet, at least for now.

CHALLENGES

- A major risk for Apple: Samsung Next's investment reveals Curve's potential, even in the face of a giant like Apple. The European regulatory context is completely reshuffling the cards, and the opening up of the NFC chip to competition could put an end to Apple Pay's dominance. If Apple Pay is used by all iPhone owners who wish to benefit from a wallet, it is above all because it is offered by default. This competition could be a real blow for Apple. Aware of the risk, the American firm is reviewing its model and is rushing to develop new functionalities, notably for its Apple Pay solution.

- An opportunity already identified by Curve: The fintech is already ready to offer its solution to iPhone owners via Curve Pay, which aims to become the number one alternative to Apple Pay. Curve Pay is a real challenger, not least because of the additional functionalities and possibilities offered by the fintech's application.

MARKET PERSPECTIVE

- According to Samsung Next, the digital payments market is currently estimated at $9,000 billion, and is expected to reach $15,000 billion by 2027. With its solution and the expansion of the market, Curve has all the keys in hand to make a difference and become a major player in the sector.

- For its part, Apple is trying to make the most of its NFC chip with new services and new use cases. In early June, for example, the Cupertino-based company unveiled a feature called Tap to Cash, enabling physical payments to be made between individuals by bringing two iPhones together.