REX: N26, another Unicorn Aiming for Global Expansion

FACTS

- just closed a $300 million Series D round table, led by the Venture Capital firm Insight Ventures Partners. Their list of investors also includes historical investors such as Tencent and Allianz.

- Key figures:

- $500M+ raised since launch

- 2.3M customers in 24 EU countries (vs 1M in June 2018)

- Valuation: $2.7Bn (vs less than $1Bn a year ago)

- €1Bn in deposits

- €20Bn in processed transactions

- Business model: N26 still is far from being profitable but they now rely on multiple sources of revenue. And depending on the market, up to 32 to 35% of their customers are subscribing premium products. Their main sources of revenue:

- Card transactions and the interchange fee

- Premium subscription fees

- Overdraft and credit offers

CHALLENGES

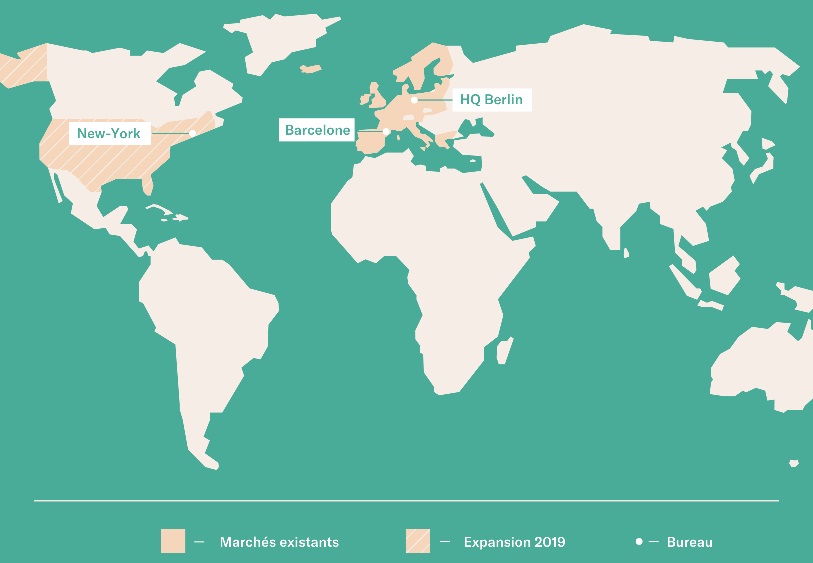

- Evolving from a European to a “Global” bank. When they first launched, N26 aimed for EU-wide reach from the start. They are now further scaling up to become a “global” banking player. They will be opening their US subsidiary in H1 2019, and would be considering 4 to 6 new markets, including in South America and Asia.

- Assist a tremendous growth. N26 changed much over the past year: significant increase in their customer bases, several new product launches (high-end N26 Metal card, Espaces savings account), increased valuation… This funding was then required for them to keep expanding at this pace, enter the US market and aim for global coverage, beyond Europe and the USA.

MARKET PERSPECTIVE

- Meanwhile, the race goes on for Revolut. A few weeks ago, Revolut was granted a banking licence. They already attracted 3.5M customers in 30 countries and their valuation reached $1.7Bn in April 2018. Just like N26, they aim to acquire 100 million banking customers worldwide in the years to come.

- Comparing these companies makes much sense as they show similar rates of growth. Yet, N26 appears to be betting more on the French market –where they claim 600,000 customers (vs 500,000 for Revolut). They also intend eventually lead the French digital banking market. If this ambition was to be achieved, they would stand out as the first pure player (challenger bank) to reach this goal, alongside long-standing banking players’ online subsidiaries.