Purse wants to harmonize payments for distributors

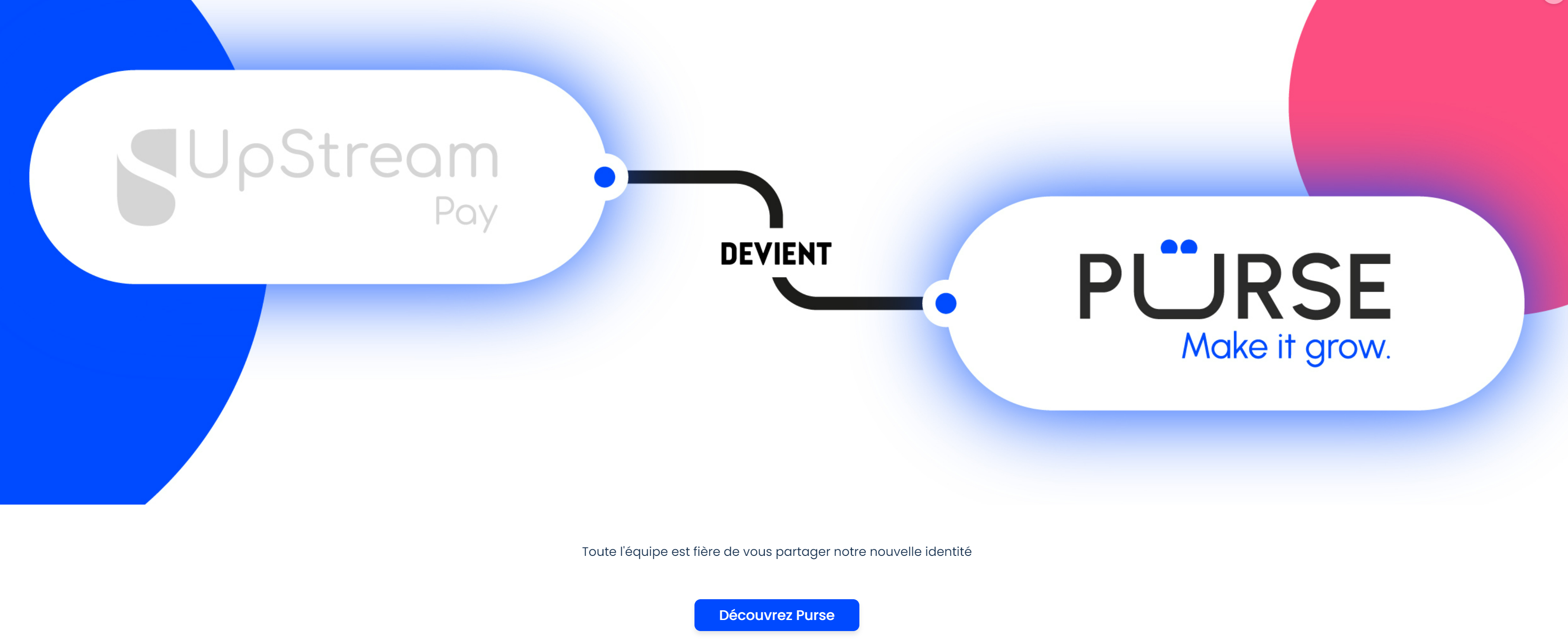

Purse wants to harmonize payments forPurse (formerly UpStream Pay) is a payment orchestration platform from the Auchan group. It offers merchants a single solution for connecting with dozens of payment providers, and is preparing for the launch of an in-store SoftPOS solution. retailers

FACTS

-

Purse presents its solution in five modules:

-

The first module comprises a list of 85 payment service providers, including :

-

PSPs (Adyen, Stripe, ...)

-

Gift cards and luncheon vouchers (Edenred, ...)

-

Wallets such as Paypal, ApplePay or GooglePay

-

Fractional payment players (Floa, Oney, Alma, etc.)

-

Open Banking players such as Fintecture and Bridge.

-

-

The second module is an intelligent payment page, co-branded with the merchant's colors, which adapts to the customer's shopping path, enabling the same basket to be paid for using several payment methods.

-

The third module is a technological orchestration block that monitors transaction progress, collects data and transmits it to maximize the acceptance rate:

-

by proposing, if necessary, a new payment attempt (retry) or redirection to another payment method.

-

-

The fourth module enables accounting reconciliation

-

And the fifth module is the dashboard for managing all services.

-

Purse's customers include :

-

Auchan, Decathlon and Chullanka (hiking equipment) and Des Marques & Vous (clothing).

-

-

CHALLENGES

-

A solution created by the Mulliez family to adapt to merchants' needs: merchants now generate nearly 20% of online revenues. They are all sensitive to the smooth running of web transactions and the acceptance of different payment methods. That's why the Mulliez family decided to fund a payment startup in 2021, called UpStream Pay. Two years later, it changed its name and launched a payment orchestration platform.

-

Rapid integration of new payment methods: Purse's promise is to integrate new payment methods within a maximum of 25 days.

-

Optimize acceptance rates: the aim is to maximize acceptance rates by resolving any technical problems or data misinterpretations that cause around 15% of transactions to fail. By working directly with payment providers, for example by having a Paypal-certified module. In this way, Purse was able to achieve an acceptance rate of 94% relatively quickly.

MARKET PERSPECTIVE

-

Purse's target market is not just e-commerce, but also the retail sector. The fintech is also preparing to launch a SoftPOS solution, which will enable in-store payments to be collected on Android terminals (smartphones or tablets) thanks to contactless functionality. The first implementation will take effect in early 2024.

-

Purse was financed by the Mulliez family to the tune of 20 million euros, enabling them to realize their European ambitions. It is already present in Belgium, and will be available in Italy, Spain and Portugal by the end of 2023.