Monzo partner of Apple on the BNPL in the UK

British bank Monzo has announced that it has signed a partnership agreement with Apple to roll out its Flex credit card, designed to provide Monzo customers with flexibility in how they pay for their goods and services within Apple Pay. This deployment allows the neo-bank to rely on a strong partner to expand its services. Apple, for its part, is further enriching its mobile payment offer.

FACTS

- Apple Pay now ships with Monzo’s split payment solution, Flex, in the UK.

- Apple and Monzo have formalized their partnership on the theme to ensure synergy of their respective services.

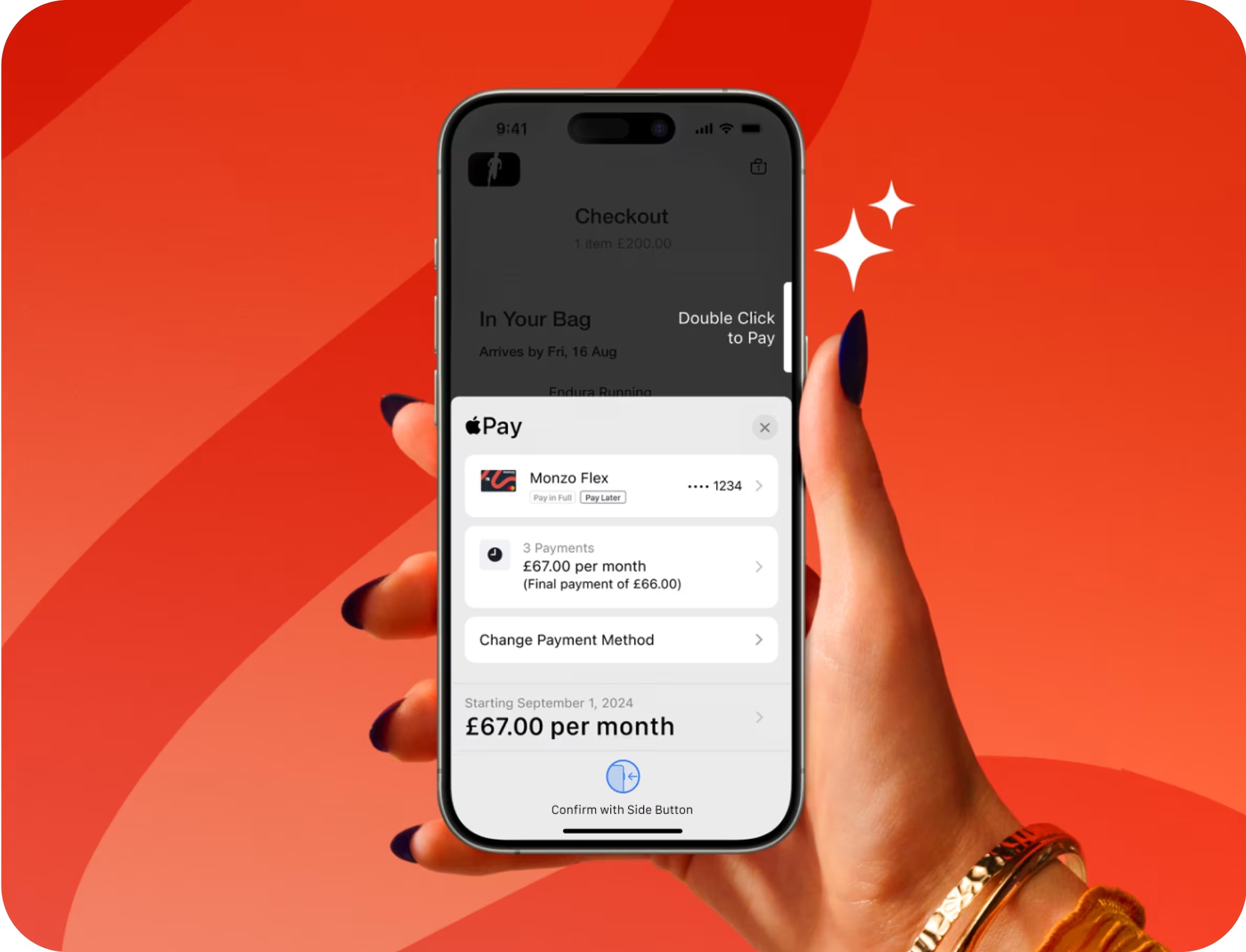

- Monzo customers who have a Flex card and iPhone or iPad in the UK can now opt for Monzo’s Flex deferred payment solution when they make a purchase with Apple Pay.

- User Journey:

- Service users will simply click the Apple Pay button when paying,

- They can then select their Flex card to access payment options,

- They will be asked to click on the "pay" button (to pay their purchase in full) or "pay later" (to benefit from the monthly payment options available, deferred or in installments).

- The service is accessible from iOS 18 or iPadOS 18 or later operating systems.

CHALLENGES

- Gain credibility: Monzo is the first partner to Apple in the UK to deploy a deferred payment solution for Apple Pay as part of the new iOS 18 operating system. It is thus strengthening its position as a major player in alternative financial services on the UK banking market and is widely expanding the use cases of its own solution for its customers.

- Spread its payment method: For Apple, partnering with local players enriches its payment service and offers added value to its users. With Monzo, Apple hopes to increase its use and presence in the European payment market.

MARKET PERSPECTIVE

- The announcement of this merger between Monzo and Apple in the UK market comes just a few months after Apple’s decision to abandon its own BNPL service. This decision does not reflect the web giant’s ambition to withdraw from financial services but rather illustrates a strategic change.

- Apple is now looking to partnerships to deploy on-board payment solutions within Apple Pay. In the US, Apple has just strengthened its collaboration with Affirm to support the deployment of a similar solution.

- Partnerships between payment specialists and web giants are not new, so Affirm has already integrated BNPL options with Google Pay or Amazon Pay for example.