Monzo launches innovative fraud-fighting tools

British neo-bank Monzo has unveiled new anti-fraud functionalities, specifically aimed at reducing the risk of phone theft. Monzo has developed three ways of validating a payment, all linked to an element external to the phone, such as location, verification by a third party, or the scanning of a specific QR code.

FACTS

- Monzo has unveiled a new security feature aimed at countering the risks associated with phone theft.

- This step is in addition to existing security steps, and aims to improve controls on large transfers and savings withdrawals. It is activated above a pre-selected amount.

- In fact, the feature can be customized. The customer begins by entering two daily ceilings to decide when the security stage is activated. They can then choose an amount for transfers and withdrawals from savings accounts.

- When these amounts are exceeded, transactions require validation, which can be carried out in one of three ways:

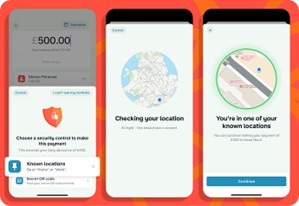

- Known locations: This allows you to define known locations for transactions involving large sums of money. Customers can register their home, workplace or any other location they consider secure. When making a payment, the application compares the phone's location with the registered locations. Validation is smooth and fast.

- Trusted contacts: For this, the customer chooses several trusted third parties. When a transfer exceeds their daily threshold, they choose one of the pre-registered contacts to validate the amount. The transaction is put on hold until the third party validates the transaction (by calling the payer or by knowing the payer's habits). If the trusted third party has any doubts, he or she can refuse to validate the payment. After validation, the payer must also validate his transaction by PIN code or biometric data, as only he is legally able to approve his own payment.

- Secret QR codes: With this option, the customer receives a personal QR code from Monzo directly by e-mail, dedicated solely to this security feature. The customer can then print it out or store it on another device. When a payment is made, the transaction is paused until the customer can scan the QR code. Once this has been validated, the payment process resumes as normal.

- Monzo has indicated that customers wishing to use this new functionality will need to set up at least two out of three functions.

- If none of the proposed options are suitable for a payment situation, Monzo has indicated that a fallback solution will be offered. This involves a video capture of one's face, enabling identity to be verified directly with a strong control.

- These new features are currently being tested by the neo-bank's teams and should be deployed shortly.

CHALLENGES

- Prioritizing security over fluidity: Increasing security when making a payment ultimately obliges banks to make the user experience more cumbersome. However, when it comes to security, users seem prepared to lose a little speed in their payment processes. Despite this, Monzo wishes to leave the choice to its customers, and this feature will remain optional.

- Focus on variety to reassure customers: The neo-bank offers a wide variety of options, enabling users to feel as comfortable as possible with the validation steps. Asking the customer to make a choice is also a way of involving them in the process without giving them the impression of being forced to add new barriers. These options are designed to protect an individual's money in the event of theft of their phone, on which all financial services are now accessible. Monzo's innovation should reassure its customers.

MARKET PERSPECTIVE

- Launched in 2015, Monzo was created with the aim of offering banking services seamlessly, directly on a smartphone. Today, the neobank addresses its services to over nine million people, in the UK and worldwide.