MoneyTrack raises funds for its insurance-directed payment platform

FACTS

- FinTech MoneyTrack has just completed a new round of funding to support its directed payment model and deploy it specifically in the health sector.

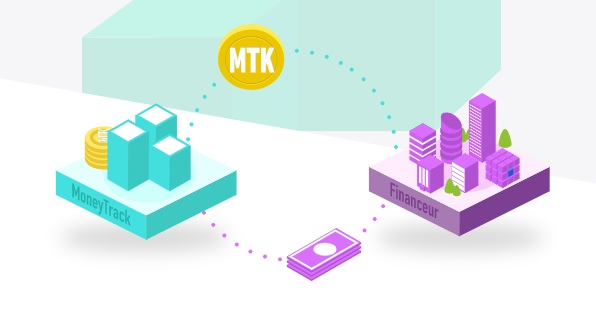

- MoneyTrack is a start-up that created a payment platform dedicated to "directed money". It allows companies, communities or institutions to make a payment under conditions for individuals. The beneficiaries of these payments can then spend them only with partners or within a predefined consumption universe.

- MoneyTrack's platform relies on blockchain technology to make these payments digital but also to secure the exchanges and control the proper use of the money paid by its partners to the recipients of the funds.

- In particular, the startup has developed a third-party payment platform in the healthcare sector. It allows to :

- authenticate the actors of the health care pathway (alternative medicine practitioners for example);

- to consult all the guarantees of the policyholders' contracts to check their rights;

- generate payments between the insurer, the complementary health care provider and the practitioner, without the insured having to pay in advance.

- Business model: MoneyTrack charges a 3.5% fee to the insurer on transactions made via its platform.

- Its model has attracted the interest of investors who have mobilized to participate in its latest round of financing. Truffle Capital, business angels and the social protection group AG2R La Mondiale have all contributed €2.3 million to MoneyTrack. This operation brings the company's total financing to €5.4 million.

KEY FIGURES

- 2018: creation

- 800,000 policyholders covered thanks to the recent acquisition of Progexia, which digitalizes the offerings of complementary health insurance companies

- 6,000 connected healthcare practitioners

- A goal of doubling turnover by 2023, to reach €100 million

CHALLENGES

- Strengthen itself through the complementarities of its partners: with its new fundraising, MoneyTrack has just announced the acquisition of the Marseille-based start-up Progexia, which will help it to fully integrate into the complementary health care ecosystem. Progexia works with a dozen mutual insurance companies (including Muta Santé, Unéo, and several overseas mutuals) that covers over 800,000 people.

- MoneyTrack relies on the implementation of smart contracts, registered within a blockchain, to trigger the transaction between the insured and the health care provider, from the verification of guarantees to the payment. A complex process that benefits from an extremely simplified customer journey thanks to the technology implemented by MoneyTrack.

MARKET PERSPECTIVE

- The managed money market is estimated to be between 3 and 5% of global GDP. Insurance compensation (home, health), affected consumer credit, discount coupons, fuel or gift cards, public social policies (transport assistance, back-to-school assistance, social payments to protected persons, etc.), humanitarian aid, etc... So many possible applications for directed money, which make it an attractive market for MoneyTrack's solution.

- In the wake of the health crisis, the economic recovery tools used by financial institutions have raised many doubts as to their effectiveness. The consulting firm Fabernovel, which dedicated a study to the uses of crypto-currencies in the face of the crisis, identifies three types of risks: exclusion, evaporation and inflation. Blockchain technology and crypto-currencies are now mature and could enable the traceability of these financial aids in a post health crisis context.