Money transfer: PaySend, the other FinTech to watch

FACTS

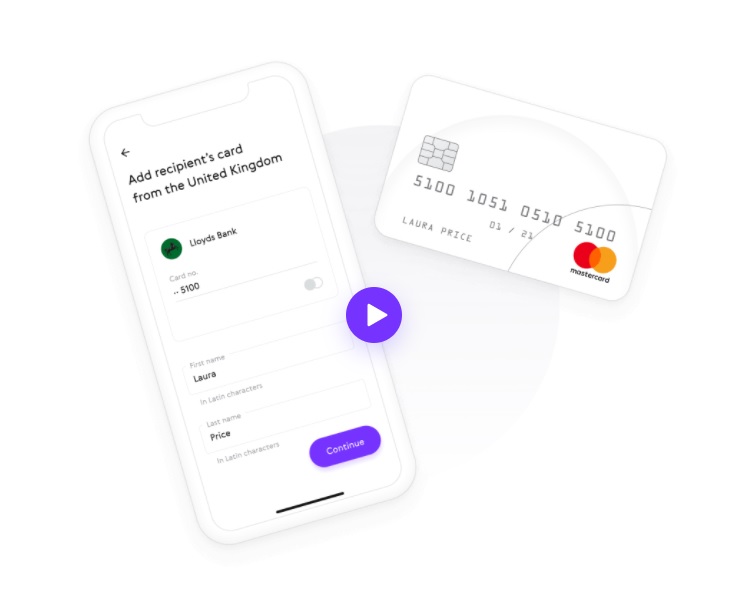

- PaySend is a FinTech specialized in international money transfers. It has just completed a new round of financing in line with its ambitions and rapid growth.

- Specialized in international money transfers, PaySend has managed to impose its service on a market dominated by historical references such as WesternUnion or Moneygram.

- PaySend currently supports connections between 12 billion cards worldwide through Mastercard, Visa or China UnionPay.

- Card-to-card payment and transfers are almost instantaneous.

- Business model: fixed fees per transaction, £1 charged per transfer in the UK for example. According to its creators, the PaySend application allows money transfers to be made at a cost of up to 60% less than the fees charged by other providers.

- PaySend is constantly enriching its offer and also provides alternative banking services to companies and SMEs to help them operate their business internationally. These services include:

- an international business account,

- a global card acceptance service,

- alternative payment methods,

- a payroll solution for employees around the world.

- The London-based startup closed a $125 million Series B funding round.

KEY FIGURES

- Launched in 2017

- 3.7+ million individual customers and 17,000 SMBs

- Operates across 60 countries and transfers funds to nearly 110 countries

- 720 million in valuation

CHALLENGES

- Conquering new territories: the new fundraising by PaySend is primarily aimed at supporting the geographical deployment of the FinTech, particularly through a partnership with Alipay.

- Ensuring internal growth: new recruitments are also planned in order to promote the development of new products and services distributed by PaySend.

- Deal with the competition: Money transfers, international payments and banking services for small businesses are all services already offered by well-known players such as PayPal, Wise (formerly "TransferWise") and Revolut. But, PaySend can count on a transparent (and fixed) business model to stand out.

MARKET PERSPECTIVE

- The fact that a relatively "off the radar" company can grow to this size speaks volumes about the market opportunity, now estimated at $133Tn.

- Last month, Paysend announced a collaboration with Plaid, an open-banking platform, that will provide it with instant authentication when customers are redirected to third-party banking providers. Investors see this as an opportunity for Paysend to enhance its service offerings for business customers.