Mollie partners with Riverty to expand its BNPL solutions

Dutch financial services provider Mollie signs a new partnership and now offers Riverty's services to merchants. Its customers can now benefit from an additional Pay Later solution, with payment terms of up to 30 days. This integration should enable both companies to expand in the countries included in the partnership, strengthening their presence in Europe.

FACTS

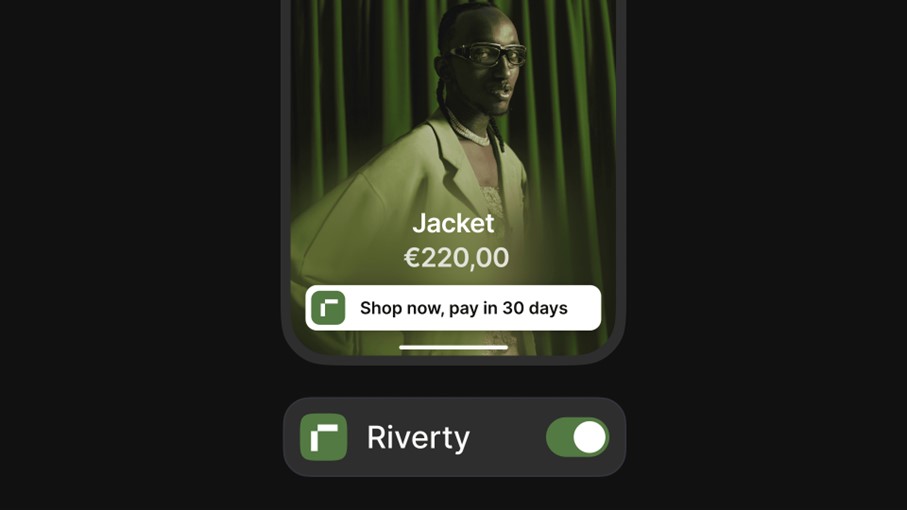

- Mollie has announced the integration of Riverty and its BNPL solution into its offering for online merchants.

- Riverty will now offer its solution, which enables end-users to pay up to 30 days after a purchase via the Dutch financial services provider.

- The payment service provider thus offers complete management of the payment process, including payment selection, invoice acquisition, payment notification and debt collection.

- Thanks to this integration, Mollie is also strengthening its payment solutions for merchants. Currently, the company offers over thirty payment solutions for e-merchants.

- Riverty's solution is available in the Netherlands, Belgium, Germany and Austria.

CHALLENGES

- A shared vision: Mollie and Riverty are both established in Europe and wish to further develop their presence in their respective markets. Mollie therefore integrates local suppliers who respond to the specific habits of consumers, thus increasing the satisfaction of retailers and end-customers.

- An offer adapted to each retailer: Riverty offers a flexible solution enabling professionals to configure the various points of contact with the customer. In this way, they can remain directly identifiable by the consumer throughout the payment process. A real strength in terms of image for the retailer.

MARKET PERSPECTIVE

- Last May, Dutch fintech Mollie reported on the quality of its performance, reflected in a return to profitability. With 200,000 customers across Europe, Mollie is developing its customer-focused positioning by offering an increasingly comprehensive payment management solution, both online and at the point of sale.

- Last March, for example, Mollie launched its Mollie Capital business financing offer on the French market. While the stated aim is to help young companies obtain financing, Mollie Capital also aims to retain customers more easily through the rapid provision of financing.