MasterCard joins forces with Ecommpay to roll out Click to Pay

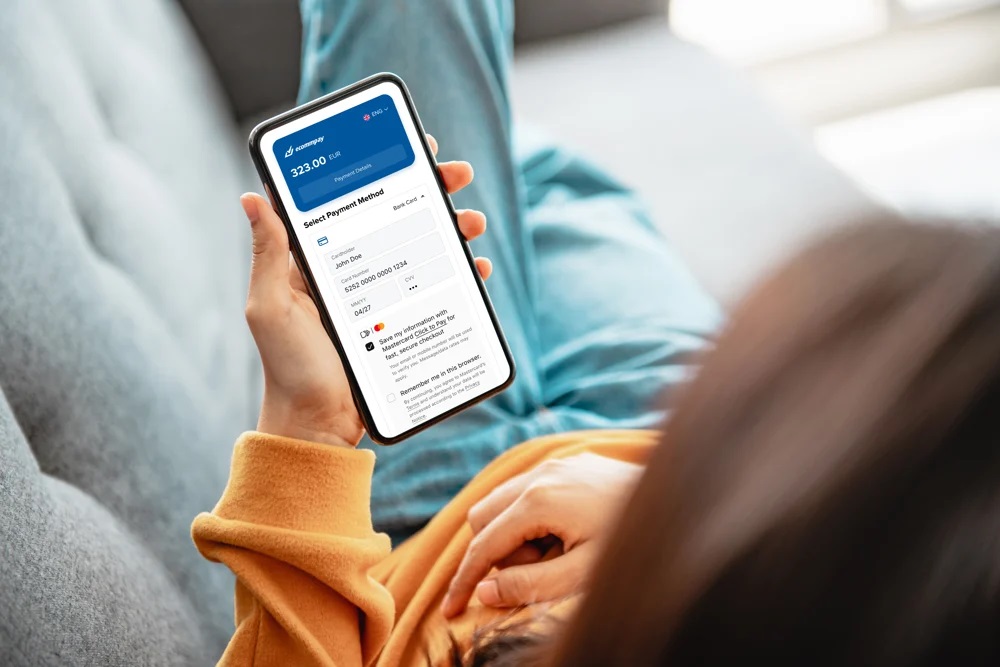

American scheme MasterCard has just signed a new partnership with Ecommpay, an international payment processing solution. Their objective is clearly stated, namely to transform the digital payments landscape. But more concretely, the two new partners have chosen to join forces to offer Click to Pay more widely in Europe, enhancing the online shopping experience.

FACTS

- This new partnership involves the adoption of Mastercard technologies by Ecommpay to enhance the security of online transactions and facilitate the integration of the Click to Pay payment solution into the Ecommpay ecosystem.

- Click to Pay is based on EMVCo standards. The solution leverages the tokenization of payment data and relies on global interoperable standards to offer consumers a seamless and more secure one-click payment on accepting sites.

- Ecommpay has fully integrated MasterCard's Click to Pay into its online payment interface. The PSP will now be able to offer Click to Pay to merchants in the UK and Europe.

- The agreement also provides for the implementation of customized solutions for customers in various sectors, including e-commerce and travel.

CHALLENGES

- Defending its ambitions: For Mastercard, this new partnership represents an opportunity to extend its influence in the digital payments sector by collaborating with a dynamic and innovative player. On the more specific theme of Click to Pay, the American Scheme has a long-standing commitment. MasterCard is said to have invested nearly $7 billion over five years to deploy its own security solutions for its 3.3 billion cardholders. MasterCard is also heavily involved in the implementation of the EMVCo Click to Pay standard.

- Gaining credibility: For Ecommpay, this partnership represents a means of gaining access to advanced technology and benefiting from the opportunity to offer its customers more robust and innovative payment solutions.

- Fighting cybercrime: Cybercrime is a major challenge today. Click to Pay solutions are presented as enhanced payment tools capable of combating risks in a digital environment. Click to Pay is faster, and eliminates the need to create an account with each merchant and enter payment details (thanks to the standard developed by EMVco).

- Boosting purchases: In addition to security, Click to Pay should also boost e-merchants' business by removing all friction in the payment process. Indeed, the payment method is touted as a way of helping merchants reduce payment times by up to 50%, and increase approval rates by around 3%.

MARKET PERSPECTIVE

- MasterCard and Ecommpay's partnership in the democratization of Click to Pay is not a first for the payment market. Last May, the American payment giant also signed an agreement with PrestaShop to launch a Click to Pay solution in selected European countries. Even earlier, in November, MasterCard teamed up with MoonPay to bring Click to Pay to Web3.

- MasterCard is stepping up its Click to Pay initiatives, particularly in response to growing competition in this area from the likes of Visa and Adyen.