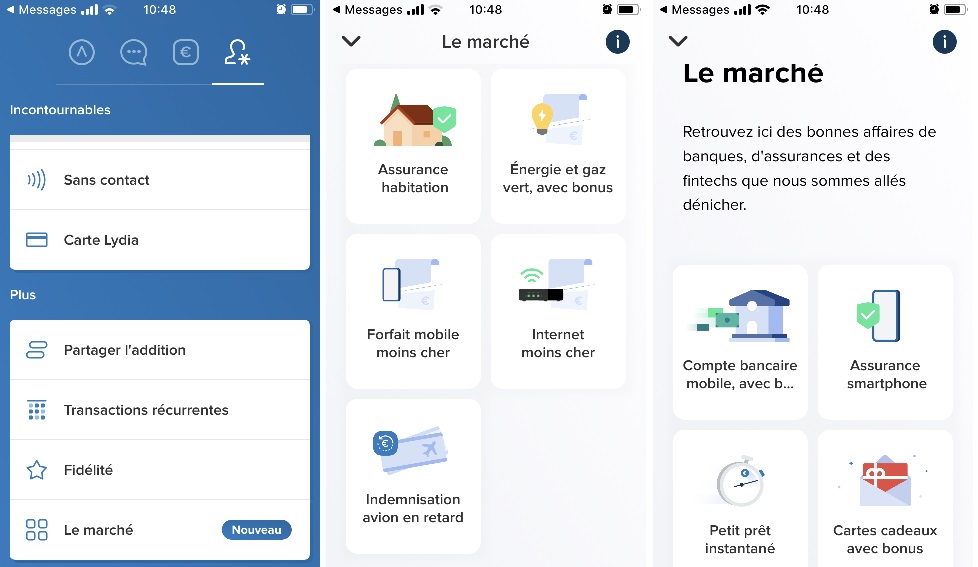

Le Marché: Lydia Structuring their Marketplace

FACTS

- Lydia has been making headway in France with their P2P payment solution. They now unveil a marketplace for financial services. This launch is consistent with the changes applied to their offer: they intended to add account aggregation services and to build a “meta” bank account.

- “Le Marché” lets customers shop through select offers from –more or less integrated– providers. Some only feature discounts from partners, while others have been fully integrated in Lydia’s process.

- Available from their marketplace:

- Bank accounts: subscribing a bank account from Orange Bank or Hello Bank! (welcome bonus: €120 and €160 respectively).

- Insurance offer from CNP Assurances for mobile devices.

- Instant loan from Banque Casino.

- Multi-risk home insurance from Luko (1 month for free).

- Service for comparing power suppliers, telcos, ISPs (with Papernest).

- Compensation in case of delayed flight via AirHelp

- Instantly available gift cards: Conforama, Aubert, Galeries Lafayette, Carrefour, IKEA, Décathlon, Etam, La Redoute, Marionnaud, etc.

CHALLENGES

- Building their meta-banking model. Lydia has been stressing the extent of their ambitions since their aggregation service was launched: a single interface enabling access to multiple financial services. This ambition is even more obvious with their marketplace: business finder’s partnership for some, and full integration for others.

- Further streamlining customer experience for the sake of customer retention. Lydia already made the point of this integration clear when they added instant loans from Banque Casino, for instance. Through relying on in-app provided financial and personal data, Lydia makes subscription processes simpler, which might entice customers not to leave their interface. This choice could eventually lead customers to leave aside their m-banking apps.

MARKET PERSPECTIVE

- For years, several industry players have been building marketplaces for financial services. They want to build WeChat-like services for finances.

- This trend has been involving challenger banks, such as Starling Bank and Yolt (by ING), as well as FinTechs including Fintonic in Spain and Credit Karma in the US.

- In France, account aggregation services (e.g.: Linxo and Bankin’) also aimed at similar goals.