Klarna prepares to integrate cryptocurrency

The Swedish giant of the BNPL Klarna continue to consolidate its offer. At the dawn of his expected IPO, it is also his co-founder and CEO Sebastian Siemiatkowski who has just revealed his ambition to soon integrate a crypto offer into his financial services. A strategic turning point for the group.

FACTS

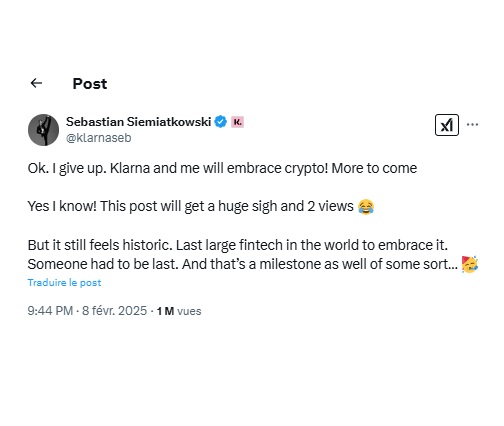

- Without further precision at the moment, the co-founder and CEO Sebastian Siemiatkowski used his X account to announce that his company, a reference for the BNPL in Europe and internationally, would soon take a turn towards cryptos.

- Klarna states that these digital assets would not be directly integrated into its BNPL services, but would ultimately be used to diversify the company's offerings.

ISSUES

- Capitalizing on a vast network : In announcing this strategic shift, Sebastian Siemiatkowski took the opportunity to highlight the Klarna network's figures, which according to him currently has some 85 million users worldwide, nearly half a million accepted traders, and a volume of transactions of nearly $100 billion per year.

- Participate in the current trend : A vast network, which could allow to participate in the democratization of cryptocurrency. A market that already represents a global capitalization close to $2,100 billion in early October 2024, according to the figures put forward by the Bank of France.

- Further development : The announcement of this diversification of Klarna's activities then comes the giant of the BNPL is preparing to ensure its introduction on the stock exchange in the United States, a priori scheduled for next April.

PERSPECTIVE

- The BNPL market continues to develop, driven by the major names of the sector, the initiatives of the historical players but also, with some studies highlighting the impact of this method of payment on the market.

- Thus, if Klarna today attracts the projectors by announcing its opening to cryptocurrency, it is also Citi that recently marked the news on the topic by introducing its own BNPL solution Flex Pay Apple Pay.

- More broadly, researchers from Imperial College Business School and the University of Leeds have recently published a study the Journal of Marketing, which examined the impact of the BNPL on retail sales. In analysing the transactions of a large U.S. retailer, the authors found that the adoption of the BNPL increases the frequency and amount of purchases, especially among small buyers and those using credit more often.

- The split payment market counts internationally and benefits market leaders. Klarna is demonstrating it again today, assuming her new ambitions for the future. But in France, Oney is considered to be the number one market for split payments. And after two tense years, his last results for 2024 show that the leader has been able to return with new results Positive.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate