Klarna launches a BNPL-based gift card service

Klarna has announced the roll-out of an innovative gift card service in the UK. This offer, accessible via the app, enables cards to be paid for using BNPL. Part of the fintech's diversification strategy, this initiative aims to capture a share of the UK gift card market. Klarna must proceed with caution, however, as the authorities are seeking to regulate the use of BNPL in the UK, which could have significant consequences for the UK market.

FACTS

-

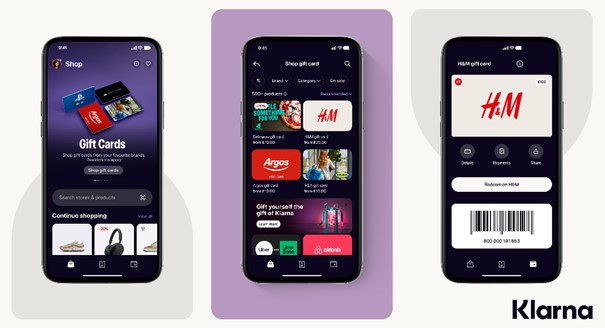

Klarna is launching a new gift card service in the UK, in collaboration with Blackhawk Network, a fintech specializing in rewards and gift cards.

- The beauty of this new service is that customers can purchase these cards directly from their Klarna app, and pay for them via BNPL's Buy Now, Pay Later services.

-

Users can therefore buy and pay for gift cards for various brands, such as IKEA, Airbnb, Adidas, Deliveroo and Uber, directly via the Klarna app. The list is set to grow.

- The “Gift Card Store” will also offer a mailing function for gift cards, with the aim of facilitating their use. Users will be able to personalize and schedule the delivery so that the recipient receives the card at the right time.

-

This launch comes after a successful introduction in the USA, and the service is then set to be offered more widely, with a planned extension to Europe by the end of 2024.

CHALLENGES

- Keeping pace with changing consumer behavior: The launch of this service once again reflects the continued adoption and use of deferred payment options. By offering a BNPL service for these products, Klarna is demonstrating its ability to adapt payment methods to consumer habits, where flexibility and control over spending are priorities for many users.

-

Attacking a promising market: The UK gift card market is currently worth £7 billion, and is expected to reach almost £9 billion by 2025, according to figures released by the fintech. Thanks to the barcodes on gift cards, Klarna intends to offer its customers the possibility of using them both online and in-store, which should further facilitate their deployment in the market.

- Reconciling gift cards and financial inclusion: Deferred payment for gift cards facilitates access for consumers looking to spread their spending. The BNPL included in the Gift Card Store will therefore add a more flexible alternative for paying for non-essential purchases, reinforcing the fintech's financial inclusion, particularly ahead of the festive December period.

MARKET PERSPECTIVE

- To keep up with competition in the BNPL market, Klarna is focusing on innovation and diversification of its services. The launch of the Gift Card Store demonstrates the company's determination to expand into new markets by entering segments that are less traditional for this type of service.

-

However, the fintech must remain cautious in the UK market, as in mid-October the government launched a consultation aimed at bringing BNPL providers under the control of the FCA (Financial Conduct Authority). The aim is to counter the harmful effects of BNPL, such as over-indebtedness, by forcing providers to apply drastic rules on calculating borrowers' creditworthiness.