Klarna extends its financial services by copying banks

Swedish BNPL giant Klarna has taken advantage of the summer break to further extend its ambitions in the financial services market. In addition to credit, since mid-August Klarna has been offering some of its customers new deposit account and cashback functionalities. These services bring Klarna a step closer to becoming a bank.

FACTS

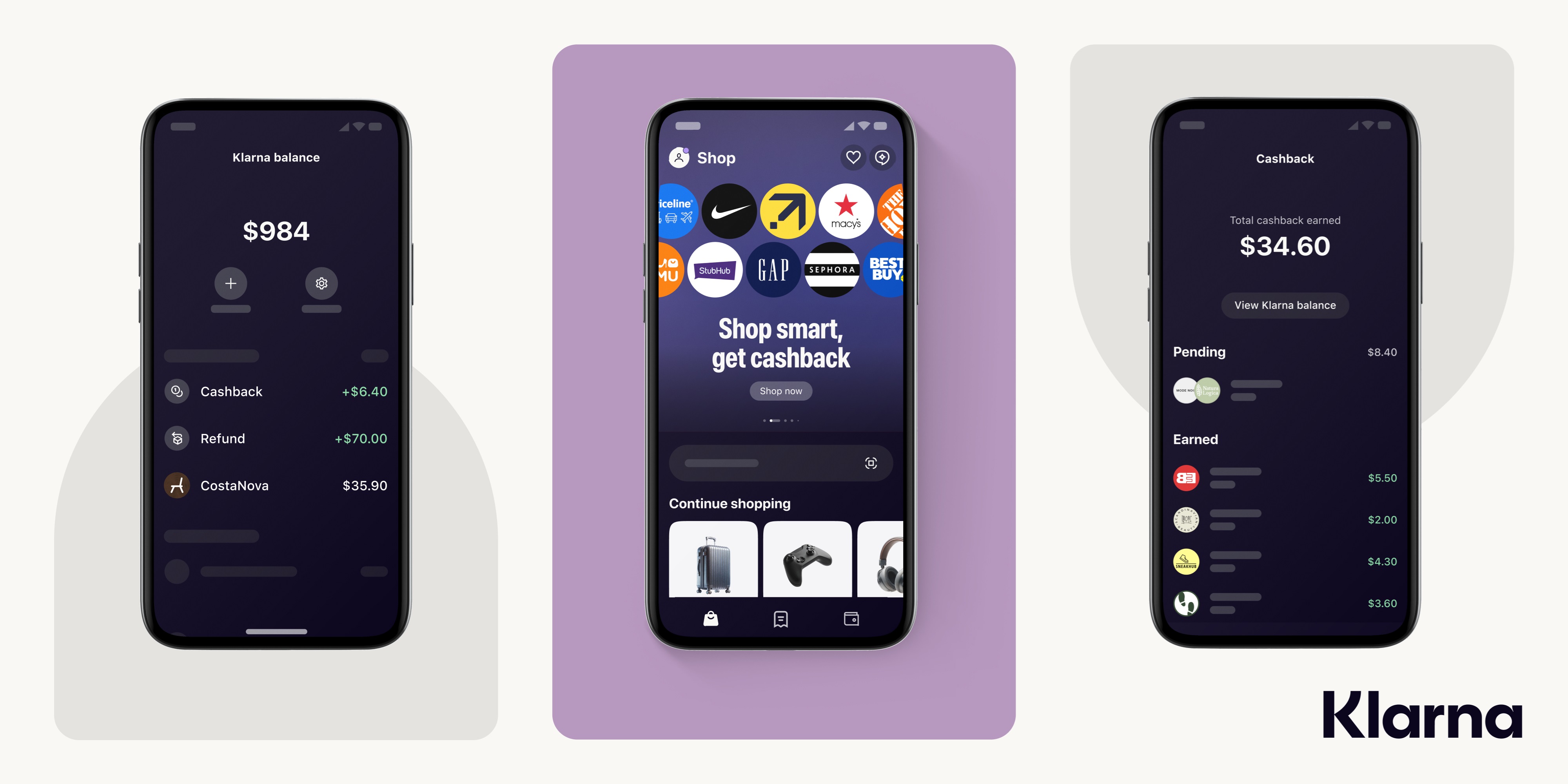

- Klarna recently announced the launch of two new products that are closer to retail banking activities: a deposit account called “Klarna balance” and a cashback service.

- “Klarna balance” allows account holders to :

- store money in a Klarna “account”,

- add money directly from their bank account,

- receive cashback rewards for purchases made at retail partners,

- receive refunds for returned items.

- Customers of these new services now receive a percentage of their purchases from participating retailers, and the money is stored in their “Klarna Balance” account. Varying according to partner stores, Klarna says the cashback percentage can be as high as 10%.

- These new offers are now available to Klarna customers in 12 European countries, including France, as well as in the United States.

CHALLENGES

- Adding locally-adapted services: While the deployment of “Klarna Balance” is international, it will take different forms in different territories. In the United States, Klarna does not have a banking license, and will have to limit “Klarna Balance” to the status of a digital wallet. In Europe, on the other hand, thanks to its license, Klarna will be able to offer interest rates of up to 3.58% on funds placed in its deposit accounts.

- Building customer loyalty: Klarna is deploying new services to further enhance customer loyalty within its increasingly rich financial ecosystem.

MARKET PERSPECTIVE

- Klarna continues to expand, both geographically and in terms of service diversification. A strategy that is paying off, as the FinTech has just revised its profits upwards for the first half of 2024, now estimated at €59 million.

- To illustrate its dynamism, beyond its new deposit account, the BNPL giant is counting on strong growth in the United States, and on international acquisitions.

- Klarna has just announced the acquisition of Laybuy, a New Zealand FinTech specializing in BNPL, which ceased operations last June. The Swedish giant is now planning to relaunch its services in the coming weeks, hoping to win back Laybuy's former customers in New Zealand - just over half a million consumers.