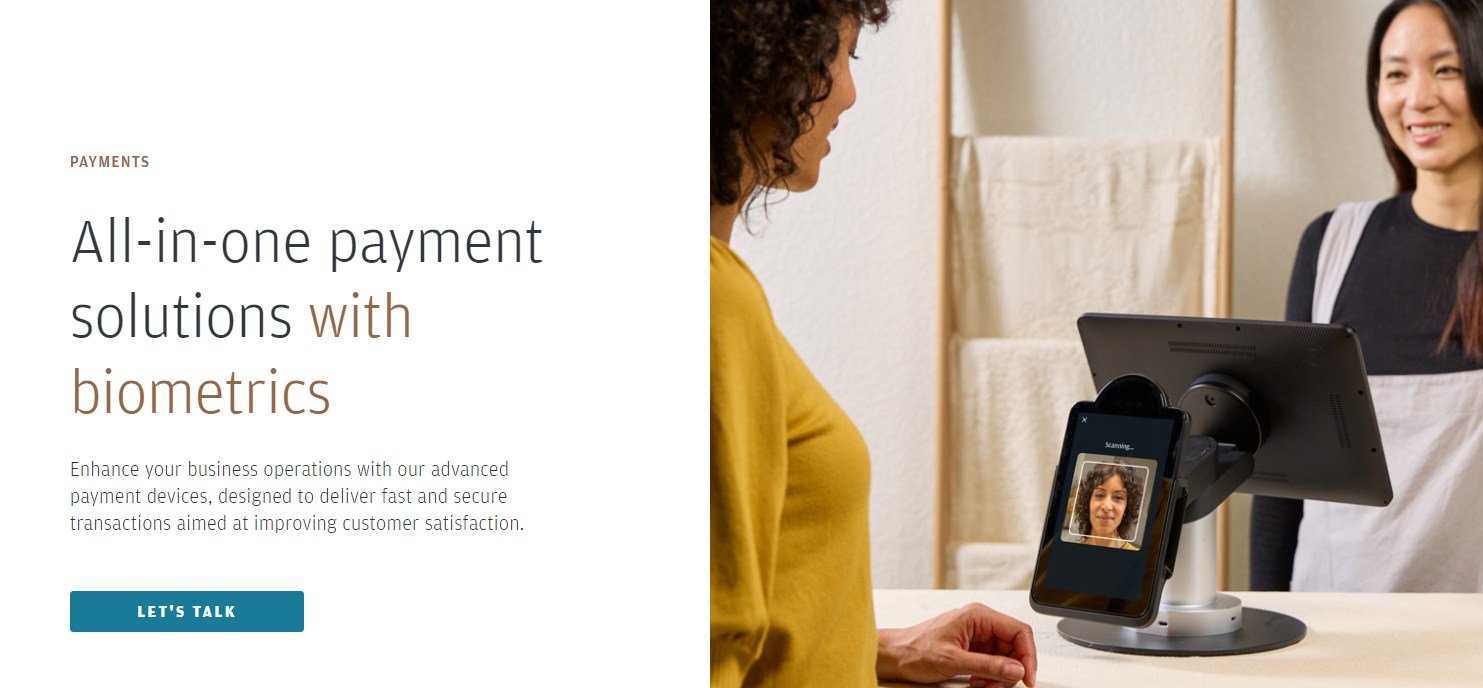

JPMorgan launches biometric payment terminals to secure and modernize transactions

JPMorgan unveiled two new biometric payment terminals, the JP Morgan Paypad and Pinpad, integrating facial recognition and infrared cameras for palm veins. These arrangements, which were planned to be launched in the United States in 2025 and then internationally, are designed to enhance payment security and upgrade commercial infrastructure. They are part of a fast growing market where biometric payments are increasingly being adopted to offer safer and more practical solutions.

FACTS

- JPMorgan recently unveiled two payment terminals incorporating biometric authentication, which will be offered to retailers at the end of the year.

These two devices, the JP Morgan Paypad and the JP Morgan Pinpad, allow traders to accept a wide range of payment methods, including chip, contactless, slip, QR code, and biometric authentication via facial recognition and infrared cameras for palm veins.

After more than a year of pilot testing, JPMorgan is preparing to deploy these terminals on its vast network of commercial customers.

The launch is planned in the United States for the second half of 2025, followed by an international expansion. The company expects global biometric payments to reach $5.8 trillion and three billion users by 2026, according to Goode Intelligence.

ISSUES

- Strengthening transaction security: The integration of biometric authentication in payment terminals represents a major step forward in securing commercial transactions. It improves fraud protection while simplifying customer experience, eliminating the need for a password or a physical card.

Modernizing Payment Infrastructure: For traders, this offers the opportunity to modernise their payment infrastructure while offering safer and more convenient methods for their customers.

A Development of Biometric Technologies: The development of these biometric technologies could transform the online and in-store payments sector, with increasing consumer adoption, particularly due to their demand for more practical and secure solutions. According to one report, almost half of online buyers in the United States are already using a biometric method to validate their payments, and 15% are interested in this option in the future.

PERSPECTIVE

- The global market for biometric payments is experiencing strong growth. As demand for more secure and practical payment solutions increases, major financial institutions, such as JPMorgan, seek to position themselves at the forefront of this technological development. The deployment of these biometric terminals is a sign of JPMorgan's commitment to capture a significant share of this emerging market.

The announcement also comes in a context where technology giants, like Apple and Google, have already made major advances in integrating biometrics for mobile payments. However, the introduction of biometric in-store solutions, through terminals such as JPMorgan's Paypad and Pinpad, marks a new step in the democratization of this technology.

Finally, JPMorgan's planned international expansion is a sign of optimism about the adoption of this technology across US borders. As the payments sector continues to diversify, the integration of biometric authentication is a challenge, but also an opportunity to enhance the security and efficiency of global payments.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate