Instant transfer at no extra cost with Memo Bank

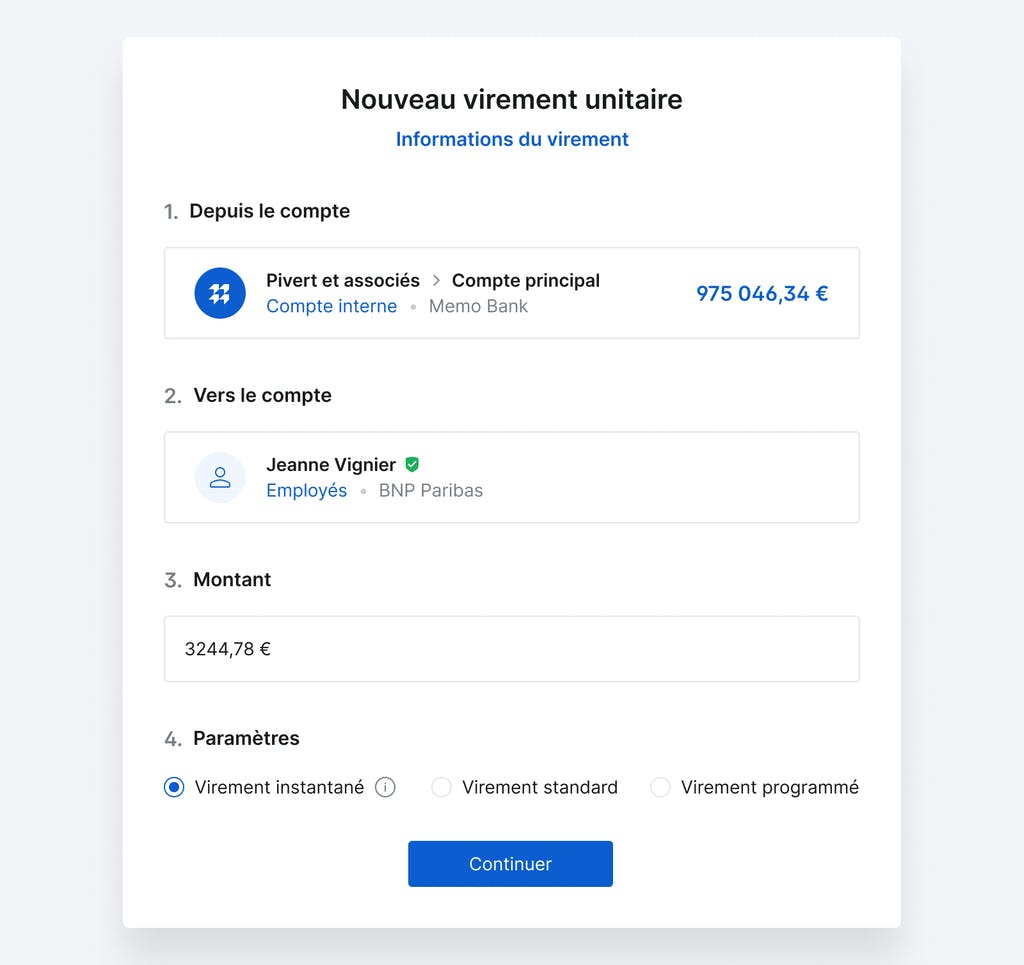

The neo-bank dedicated to professionals, Memo Bank, is continuing to build a complete offer for businesses. It is presenting its instant transfer solution, which is perfectly in line with the trend, but which nevertheless manages to differentiate itself thanks to a low-cost pricing approach.

FACTS

-

Memo Bank becomes the only bank to offer an instant transfer solution at no extra cost to its customers: companies.

-

To achieve this result, the neo-bank is bypassing the intermediary and connecting directly to RT1, EBA Clearing's European payment system for instant payments in euros.

-

In this way, Memo Bank intends to democratise the instant transfer, whereas the deployment of the service has so far been limited by the costs involved.

-

As a reminder, the SEPA instant transfer allows a transfer of up to 100,000 euros to be made or received at any time within the SEPA zone in the space of 10 seconds, compared with 1 to 3 days for a standard transfer.

CHALLENGES

-

Building a complete offer: At the beginning of the year, Memo Bank presented a new service for managing business expenses. The launch of its instant transfer service thus confirms the dynamism of the young neobank.

-

Confirming its ambitions: The presentation of this new service was nevertheless expected. Memo Bank had indeed obtained the status of "direct participant" in the STEP2 settlement mechanism at the beginning of the year, authorising it to carry out instant transfers for certain larger amounts and thus opening up the salary payment market.

-

Countering an established model: The cost of using instant payment services by banks is estimated at around Yet instant payments are charged €1 per transaction on average according to the ECB. For its part, Memo Bank intends to establish itself a little more as a partner for companies with a price argument for a service that is in line with the times.

MARKET PERSPECTIVE

-

The subject of instant transfers is more topical than ever in the world of payments. Memo Bank is not the only FinTech to play this card in France.

-

The French FinTech SlimPay has also just announced the launch of its new solution: SlimCollect. It uses Open Banking technologies to provide a new account-to-account payment option for European merchants, using instantaneous bank transfers.