ING Invests in BtoB Account Aggregation

ING just invested €7.5 million in Cobase, a FinTech focusing in account aggregation for large-scale companies. This investment stresses their interest in an Open-Banking approach.

ING takes a majority stake in the Dutch start-up Cobase via a €7.5 million investment. This transaction follows on from an ongoing partnership as this FinTech was incubated by ING Wholesale Banking in 2016. They also co-created a platform with ING customers.

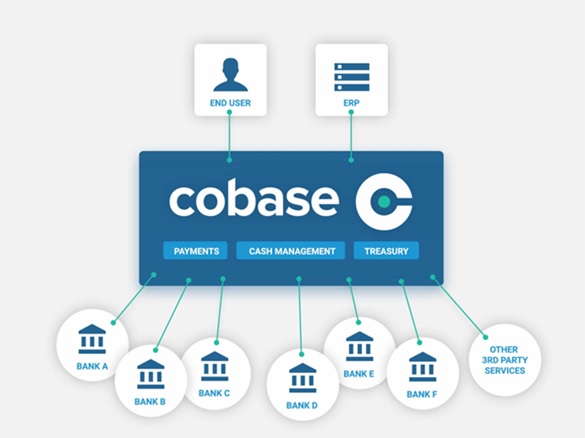

Their Cloud-based solution lets businesses aggregate multiple bank accounts, including abroad-located accounts, and have access to a centralised view through a single online interface.

This online portal also allows them to perform a certain number of transactions: initiate payments, handle cash-management operations, etc. Cobase will rely on this investment to expand beyond Europe and attract new customers. They will be designing new features likely to be implemented in 2019: a “robo-assistant” for transaction tracking, a meeting module, and even cash forecasting mechanisms.

Comments – ING: an Open-Banking approach to reach out for Europe

Cobase will be owned by ING through their Financial Transaction Services subsidiary. They will remain independent, free to choose their own strategy and management options. This operation is in line with ING’s own strategy and collaborative approach. They are already working with more than 150 FinTechs worldwide.

Even before the EU-wide implementation of PSD2, ING started an active Open-Banking dedicated plan. Until recently, they chiefly acted as an open aggregator, connecting their services and their rivals’ services: for instance, the UK-based BtoB aggregation account Yolt which is aiming for European reach. Cobase, for their part, targets large-scale companies looking to aggregate accounts and services for medium and large-scale businesses. This strategy may be successful if these aggregators keep scaling up, enabling ING to capture more data about their potential customers.