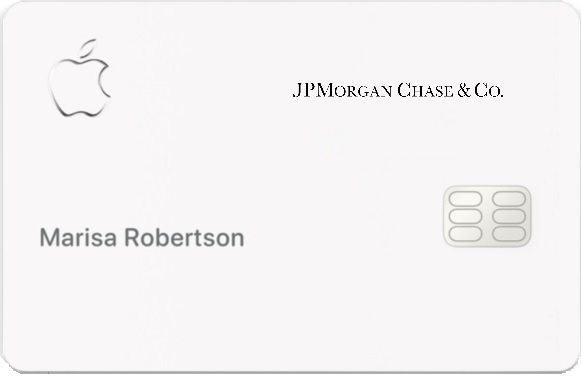

In brief: The Apple Card will finally be issued by J.P. Morgan Chase

After months of rebounds, and despite the setbacks, J.P. Morgan Chase has just formalized the fact that she was going to replace Goldman Sachs as the issuer of theApple Card In about 24 months. Mastercard will be kept as a payment network.

Chase will therefore become the new Apple Card issuer within approximately 24 months, a necessary time to ensure the transition of services and the replacement of Goldman Sachs.

Migration should be transparent for users; Apple Card holders will retain the current benefits: cashback up to 3%, expense management tools, high-rate savings account, Apple Card Family, payment multiple times without charge, etc.

The portfolio to be transferred represents over $20 billion in outstanding cards, significantly affecting Chase's card business.

This announcement is also part of a long-term partnership strategy between Apple, Chase and Mastercard. The three partners want to raise market standards on banking innovation (digital experience, simplicity, security, budget support tools).

Mastercard's involvement in this new partnership cuts short of Visa's ambitions which was ready to put $100 million on the table for recover Apple Card.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate