In brief: Apple launches its BNPL service in the United States

On March 28, 2023, Apple finally launched its fractional payment service for some of its customers in the United States. A release that will perhaps overshadow other BNPL players like Klarna and Affirm who are going through a difficult time.

Apple will initially offer the service to a small number of its customers in the United States.

As "Buy Now, Pay Later" sees its financial model hit by rising interest rates, Apple on Tuesday rolled out its service to a few of its customers in the United States.

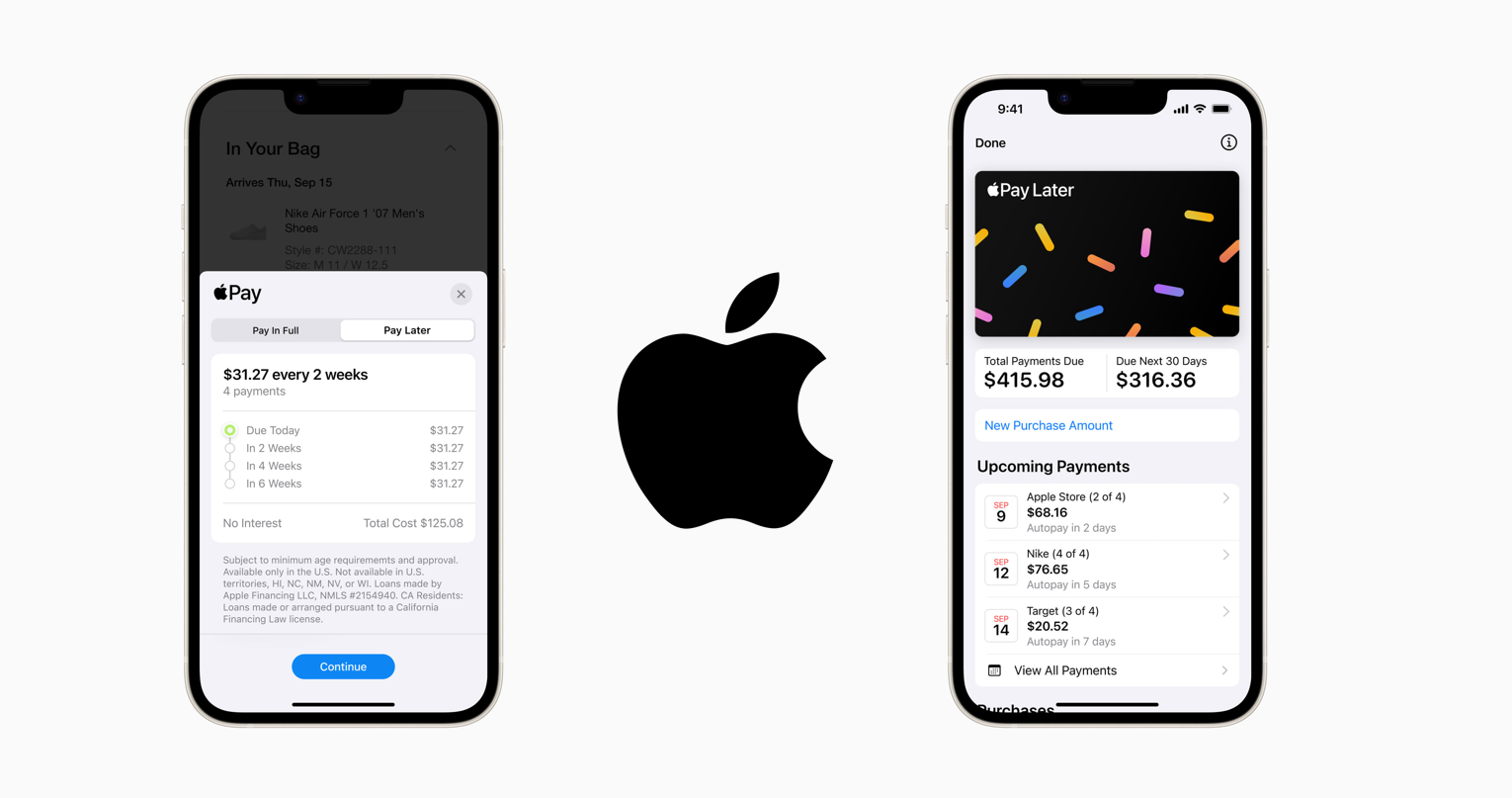

Apple Pay Later, announced last June, is built into the "Wallet" feature of the iPhone and iPad and allows Apple Pay users to split a purchase between $50 and $1,000 into four equal payments over six weeks without interest or late fees.

Apple Pay users can use it to make purchases online or in-store, and the service leverages Mastercard's network. Merchants don't have to do anything to accept the service if they already accept Apple Pay.

Goldman Sachs is giving Apple access to Mastercard's network because Apple can't issue proof of payment directly. After the initial loan application, Apple ensures that the customer's financial situation is good before approval. The credit analysis (credit scoring) is carried out directly by Apple Financing, a subsidiary of the group's financial sector.

As a reminder, Apple has already partnered with the Wall Street giant to launch the Apple Card, its credit card, in 2019.