GoCardless relies on Open Banking to fight fraud

GoCardless has announced the launch of its Verified Mandates service in France. It is presented as an Open Banking feature capable of helping merchants reduce fraud while providing a better customer experience. A predictive model that should demonstrate the value of combining direct debit with the Account Information Service (AIS).

FACTS

-

Verified Mandates is the new service presented by GoCardless in France. It is particularly aimed at e-retailers.

-

The service is directly linked to the GoCardless banking payment platform. It combines the Account Information Service (AIS) enabled by open banking with direct debit.

-

What's it all about? To fight fraud before it happens.

-

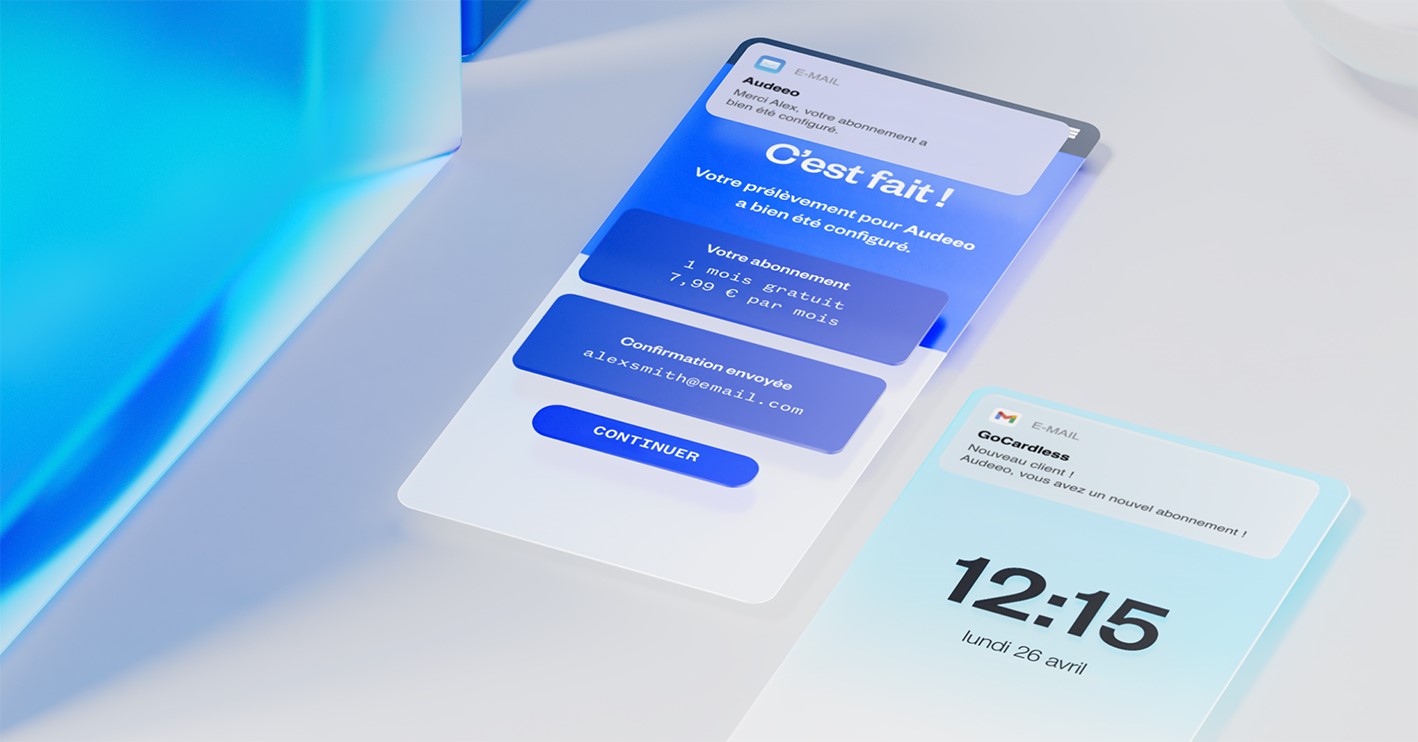

How do we do this? Through a three-step verification process:

-

the paying customer creates a direct debit mandate,

-

the payer chooses his bank to connect to his online account and authorise the mandate,

-

the merchant receives instant confirmation of the customer's identity verification, and the customer can then validate the payment.

-

-

Before France, these Verified Mandates have already been launched by GoCardless in the US, the UK and Germany.

CHALLENGES

-

Confirm the relevance of its offer for e-commerce: In 2021, the London-based FinTech stated that it wanted to rely on Open Banking to impose its solution on the growing e-commerce market. At the time, it was seeking to present itself as an alternative to card payments. By adding a layer dedicated to the fight against fraud to its offer, it is now putting forward a new argument.

-

Responding to a major problem: According to a study carried out by GoCardless, 55% of French merchants consider fraud to be a major threat, or even the main risk to their business. 53% of them nevertheless declare that they continue to provide goods or services before having verified the authenticity and veracity of a customer's banking information. This is a problem based on a lack of time and resources, which GoCardless intends to address with Verified Mandates. The risks are particularly high in the e-commerce market; Juniper Research indicates that losses related to online payment fraud are expected to reach 48 billion dollars by 2023.

MARKET PERSPECTIVE

-

Founded in 2011, GoCardless has developed a scheme that allows businesses to accept recurring SEPA direct debit payments. Since then, it has gradually established itself as a benchmark in its market, including in France, where it has been consolidating its ambitions since setting up in 2015.

-

Its model seems to have succeeded since the British FinTech has since established itself as a European Unicorn. It obtained this status at the beginning of the year, consolidating at the same time its ambitions to accelerate its growth in open banking.