Fragmented payments: Jifiti also enters the BtoB market

The American fintech Jifiti offers a white-label platform for fragmented payments and has just announced that it is expanding its BNPL offer to BtoB clients. This diversification is part of a massive movement by BNPL players towards the BtoB commerce eldorado, already initiated by players such as Hokodo, Klarna (with Billie), Pledg, Franfinance or Younited.

FACTS

-

Jifiti is a platform created in 2011, which offers white label credit and fragmented payment solutions for financial institutions and merchants.

-

So far focused on BtoC commerce (online and at the point of sale), Jifiti announces a rather logical expansion of this platform towards BtoB commerce.

-

Technically, it is the same platform, which will cover all the needs of its customers, whether it is to address the BtoC or BtoB segment, with two integration possibilities, either via APIs, or via the issuance of a virtual card that does not require any integration with the site or the merchant (in partnership with Mastercard).

-

In terms of products, Jifiti will offer both split payments in 3 or 4 instalments and 30-day deferred payments; its platform also manages assigned credits and lines of credit.

CHALLENGES

-

Offering an exhaustive vision of Buy Now Pay Later: Jifiti's main specificity is to offer all types of white label credit products, without the need for technical integration, in a very exhaustive perspective, where the fintech mainly operates in the back-office for the supply and management of a turnkey technical platform. It is the type of use case that Jifiti has, for example, entered into a partnership with IKEA to manage all of its point-of-sale payment facilities worldwide.

-

Helping merchants leverage their data. The other specificity is that Jifiti allows retailers to keep control of their customer data in order to exploit its full value. Its platform therefore offers retailers a module for retrieving and visualising this data. The same is true for the brand, unlike other players, such as Apple or Klarna, where the solution involves valorizing their own brand.

MARKET PERSPECTIVE

-

Many fragmented payment players, initially positioned on the BtoC market, are beginning to explore the potential of the BtoB market, particularly in e-commerce. This is the case, for example, of Pledg, which, via a partnership with Allianz Trade for company scoring, has set itself the goal of replicating in BtoB the quality of BNPL's pathways that BtoC e-commerce is experiencing.

-

Klarna has also started this diversification with Billie in 2021. Today, Klarna is announcing a partnership with Krea, a Swedish broker specialising in credit for SMEs. Klarna's open-banking platform (Kosma) has been mobilised to make it easier to score companies. As a result, they obtain higher loan amounts (+15% on average), for lower interest rates (-4% on average).

-

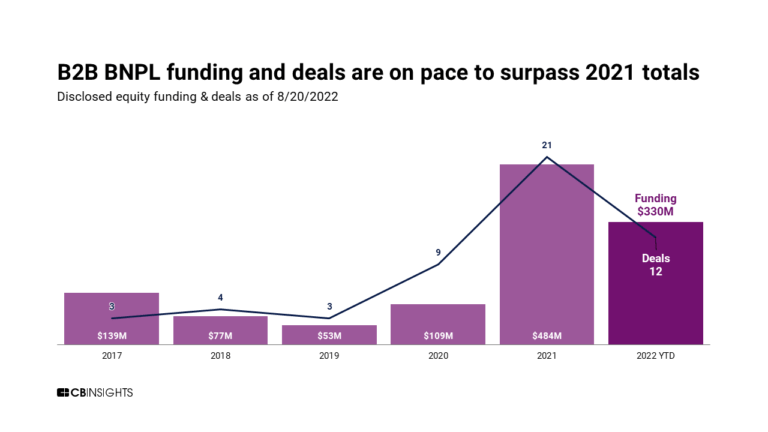

This craze for BNPL BtoB is also reflected in the figures: according to CBinsights, the amounts raised by BtoB BNPL players in 2022 should exceed those of 2021, which had already been rising sharply since 2019.