Fipto facilitates stablecoin payments with Payment Links

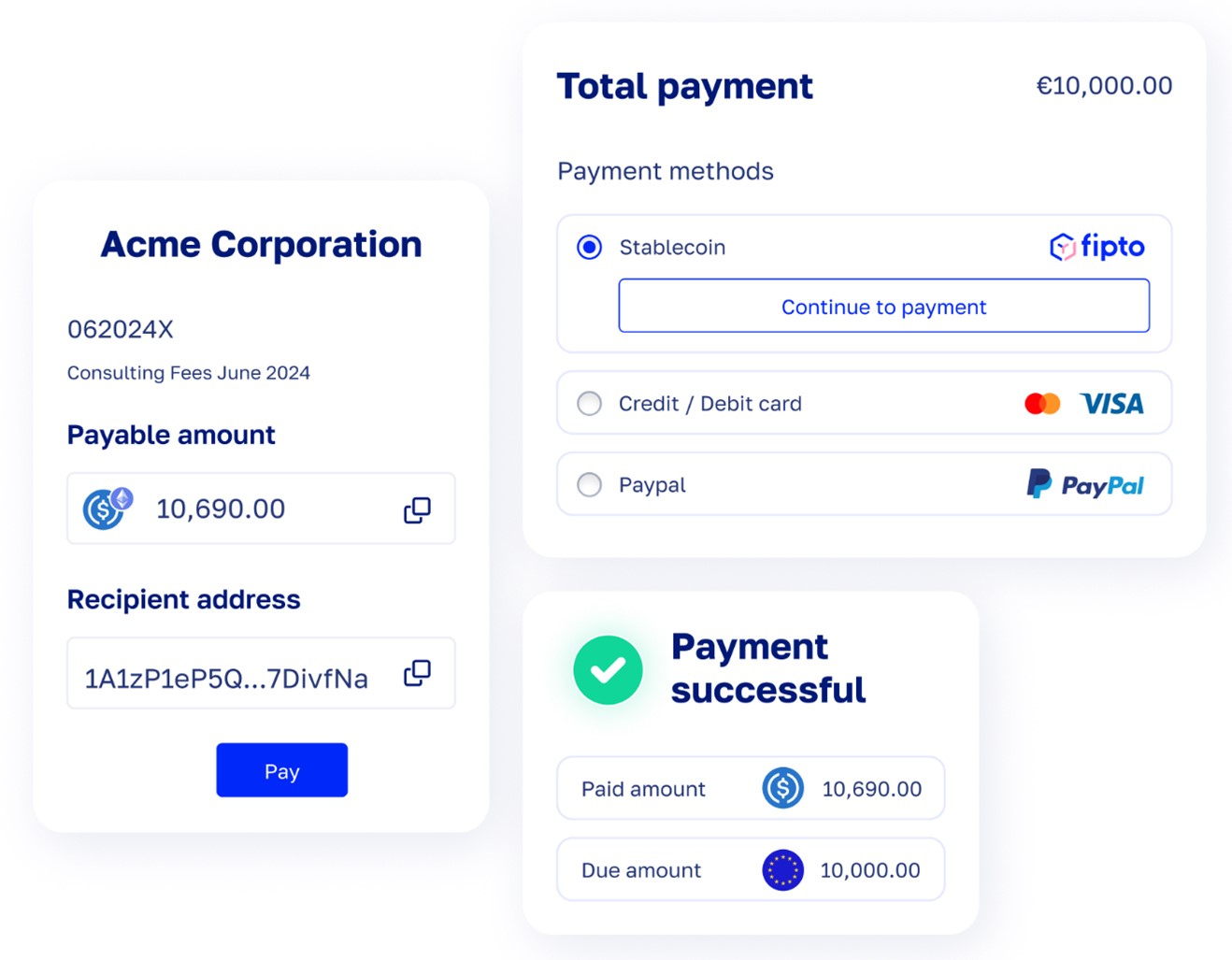

Fipto, the French blockchain-based B2B cross-border payment and cash management company, has made official the launch of its newest feature. It is Payment Links, a solution for collecting payments in cryptocurrency, aimed at professionals. Although these technologies are becoming increasingly widespread, they still face a number of reservations. With its solution, Fipto aims to overcome these obstacles by offering a way of accepting these currencies without having to deal with them directly.

FACTS

-

At the end of April, Fipto announced the launch of Payment Links, a feature enabling businesses to collect payments in stablecoin and receive them directly in euros to their bank accounts.

-

The company points out that the functionality is suitable for all types of businesses, even those that are still reluctant to introduce cryptocurrencies into their way of doing business.

-

Fipto has also identified several use cases for its customers:

-

B2B invoicing for SMEs: This would allow businesses to use cryptocurrencies as a universal currency allowing simplified exchanges with unsupported foreign currencies.

-

Payment for e-commerce merchants: Adopting Payment Links would be a way for e-commerce players to offer an additional payment solution to their customers.

-

Deposits for foreign exchange and gaming: by offering a simple and accessible cryptocurrency deposit.

-

-

In practical terms, the solution automatically converts the transaction between euros and stablecoins. It also handles the problems of overpayment and underpayment, making it possible to manage currency conversion issues, etc.

-

Users have access to a consolidated page giving them an overview of their activity, including payment statuses, as well as a complete and individual view of each transaction.

-

To use the functionality, Fipto suggests using payment links. Users fill in the required information and then send the link to their customers so that they can make the stablecoin payment.

-

The payment links developed will also be available via Fipto's API, for companies wishing to customise the solution as much as possible.

-

For the time being, Fipto accepts four stablecoins: USDT (Ethereum blockchain), USDC (Ethereum blockchain), USDT (Polygon blockchain) and USDC (Polygon blockchain). The list is set to grow.

CHALLENGES

-

Streamlining B2B exchanges: With Payment Links, Fipto aims to simplify B2B exchanges, the proportion of which involving cryptocurrencies is on the rise. Companies are interested in stablecoins to diversify their cash flows.

-

Functionality accessible to all: With Payment Links, Fipto has developed a feature that enables everyone to benefit from the advantages of blockchain :

-

without having to interact with the technology,

-

without the risks associated with using digital assets.

-

-

Responding to a growing market: The use of stablecoins by professionals is becoming increasingly widespread, with 30% of businesses already reportedly using cryptocurrencies for their international transfers, according to Deloitte. Fipto sees its solution as an easy and secure way of meeting this need and thus simplifying businesses' entry into the world of blockchain, a major challenge even today.

MARKET PERSPECTIVE

-

The position of cryptocurrencies is evolving in the payments sector. Innovations in gateway solutions between fiat currencies and cryptocurrencies are multiplying and gradually showing that everyday use of digital assets could become a possibility.

-

With this in mind, the payment giants are developing their links with Web3. In January, Visa inaugurated the launch of a loyalty platform for Web3 customers. For its part, Mastercard has entered into partnerships with players such as MoonPay, with the aim of getting closer to Web3.