Feedback: When Apple Pay goes beyond historical schemes

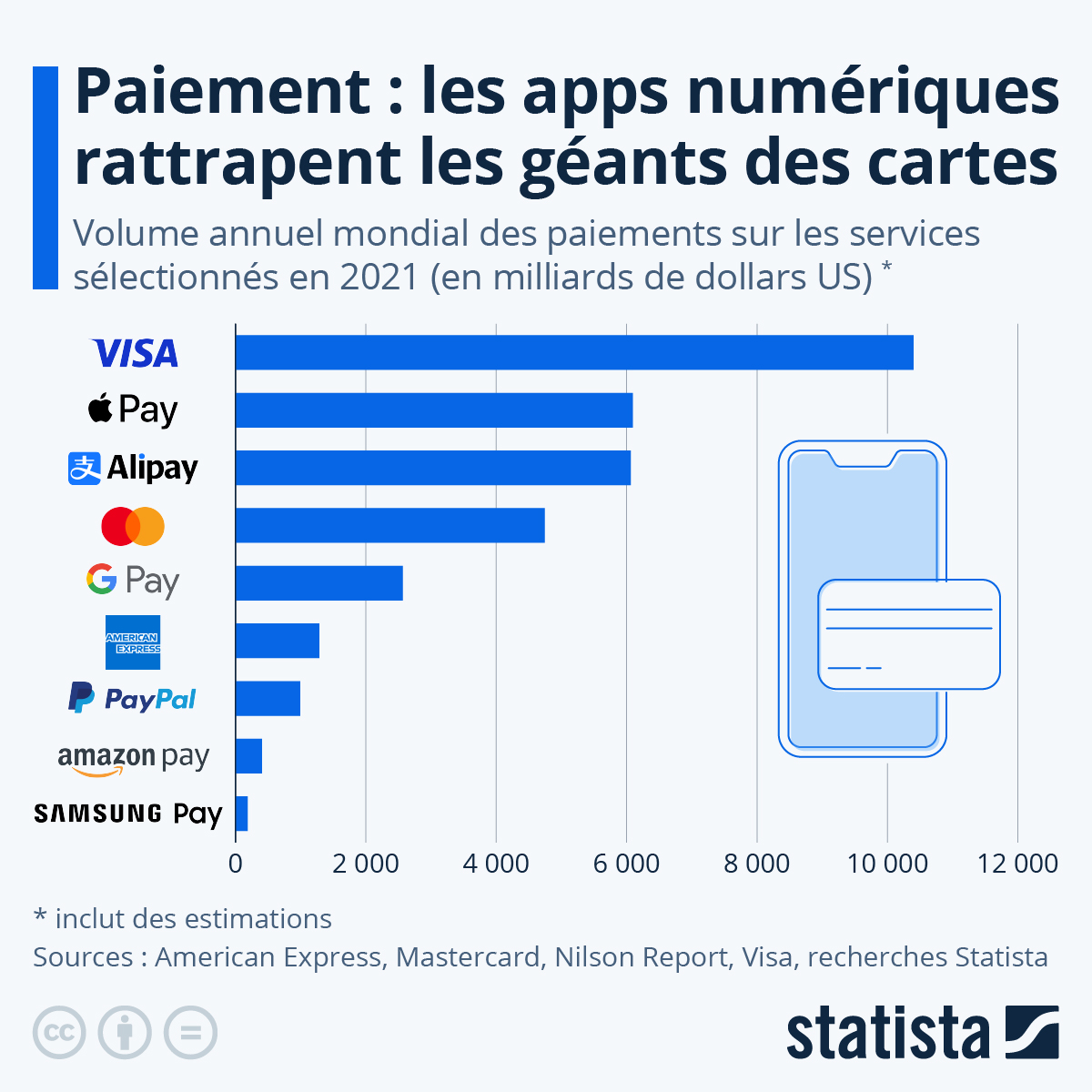

The figures were recently released, highlighted by TradingPlatforms. They illustrate a major turnaround in the payments market, with mobile payments playing a major role. Indeed, Apple Pay usage is said to have exceeded MasterCard's worldwide usage over the course of a year. This illustrates the rise of a service with broader ambitions.

FACTS

-

Apple Pay usage is growing as acceptance of the service expands around the world. But the big market turnaround is that Apple Pay has finally overtaken MasterCard in the amount of annual transactions processed.

-

Apple Pay now processes more than USD 6,000 billion in annual transactions worldwide, ahead of MasterCard, which processes less than USD 5,000 billion.

-

To achieve this goal, Apple has been able to count on the global deployment of its offer, which has conquered nine new countries in 2021. If Apple Pay succeeds in establishing itself in Korea as the group envisages, its global reach could cover some 60 countries.

-

In 2021, Apple Pay accounted for 92% of all debit transactions made via mobile wallets. In addition to schemes, Apple Pay largely dominates its direct competitors.

-

The strength of the service is based in particular on the very wide distribution of Apple devices; 1.8 billion of the brand's terminals are active in the world.

-

However, the mobile payment service is still a long way from the undisputed leader of the global payment market, Visa, and its 10,000 billion dollars worth of transactions processed each year.

CHALLENGES

-

A growing appetite: In addition to Apple Pay, the web giant is no longer hiding its ambitions to dominate the payment market more broadly, including acceptance. To this end, Apple launched its Tap to Pay service at the beginning of the year to turn its iPhones into payment acceptance devices.

-

A double-edged development: This race is nevertheless not without consequences for the web giant, which must also face the realities of the market. Thus, if with IOS 16, Apple wanted to free itself from the banks by unveiling its own "Pay Later" option, the group must finally review its ambitions. The reason for this is the problems linked to the development of the service and, as a result, a launch planned for 2023 instead.

-

The rise of Apple Pay is not only marked by positive aspects. Apple also has to deal with the consequences of its appetite for the market, including accusations of anti-competitive practices in the US.

MARKET PERSPECTIVE

-

Apple's rise to power against the card giants illustrates a deeper trend in the empowerment of alternative players in the payment market. If Apple is the benchmark, it is ultimately also the FinTechs and web giants that are catching up with the incumbent schemes in their own market.

-

The Covid-19 pandemic has largely contributed to accelerating this trend, which was already emerging before the crisis. And today, while Visa remains the undisputed leader in payment systems worldwide, MasterCard and American Express are no longer on the podium.

-

In addition to Apple, these historical players have also been overtaken by Alipay, the third largest payment service provider in the world in terms of volume of transactions processed. According to Statista data, MasterCard is fourth in the market, followed by Google Pay and then only by American Express, PayPal, Amazon Pay and Samsung Pay.