Deblock has obtained PSAN approval

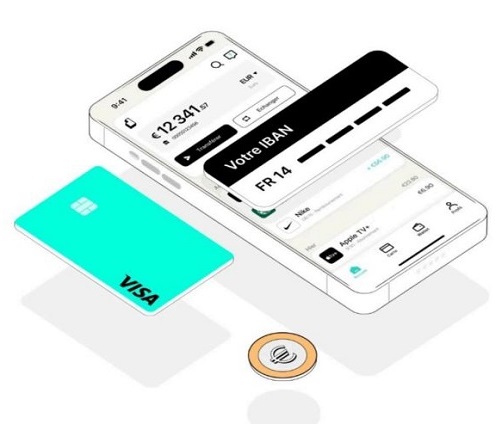

Start-up Deblock, which offers an innovative model combining a current account and a crypto wallet, is the result of a combination of expertise between its co-founders, from neo-bank Revolut, and French unicorn Ledger, a specialist in hardware solutions for securing crypto-currencies. The company recently confirmed its market position by becoming the first FinTech to receive PSAN accreditation in France.

FACTS

-

While Deblock presents itself as the first crypto wallet backed by a current account, it can now also claim to be one of the first to receive PSAN approval certified by the Autorité des Marchés Financiers.

-

PSAN accreditation imposes obligations, particularly in terms of investor protection. It must therefore confirm the seriousness of Deblock's offering on the market.

-

Obtaining this new approval also paves the way for the international development of Deblock's services, at least on a European scale.

CHALLENGES

-

A first... for a FinTech: While Deblock is indeed the first fully-fledged Fintech on the French market to obtain PSAN certification, it is not the first player to have achieved this feat in the country. Indeed, it was Forge, Société Générale's subsidiary dedicated to crypto-assets activities, which became the first French PSAN (Digital Asset Service Provider), certified by the

-

Autorité des Marchés Financiers in July 2023. However, Deblock differs from Forge in the nature of the services it offers to the general public.

-

Reinforcing its accredited status: Until now, Deblock has relied on its accreditation as an e-money institution by the French banking regulator, the Autorité de Contrôle Prudentiel et de

-

Résolution (ACPR), and on its PSAN registration to justify the seriousness of its offerings. Its new approval now formalizes its offer.

-

Confirming the sustainability of its activities: As a reminder, with the implementation of the MiCA regulation, PSAN approval will be mandatory from July 2026 for any company wishing to operate activities linked to the management of crypto-assets within the European Union, i.e. crypto-asset service providers (CASSPs).

MARKET PERSPECTIVE

-

Deblock has shown considerable dynamism in recent months. Last April, the fintech announced that it had raised funds to develop its model. At the time, it was combining a current account with a crypto Wallet in order to renew its customers' experience, make exchanges more fluid, and also democratize cryptoassets in general.

-

At the time, the FinTech was aiming to attract some 200,000 users by mid-2025, but it has yet to specify the status of its customer portfolio or the progress it has made towards achieving this goal.