CB unveils Contactless Plus for proximity payments

GIE Cartes Bancaires has announced the imminent arrival of Contactless Plus at French retailers. This is a contactless payment method for purchases over €50. More fluid and as secure as ever, this payment method illustrates CB's intention to relaunch its local payments business in the face of the growing power of private players and foreign schemes.

FACTS

- GIE Cartes Bancaires has announced that "Contactless plus" is now available on payment terminals in France.

- The payment method is similar to conventional contactless payment, but allows payments to be made for amounts over €50.

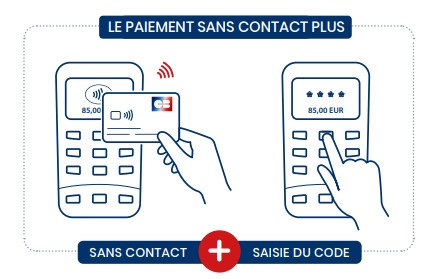

- In concrete terms, the merchant enters the amount. The customer then places his or her card on the Eftpos terminal as if making a conventional contactless payment. As the amount exceeds €50, the PIN code is required, so the customer can enter it directly on the Eftpos terminal, without inserting their payment card.

- However, this option is not available if the Eftpos terminal is offline at the time of the transaction. This is because the PIN code is instantly verified online by the issuing bank. In this situation, the customer is obliged to insert his or her card.

- This feature should be available gradually across the country, once merchants have completed the necessary upgrades.

CHALLENGES

- A major development in proximity card payments: "Contactless Plus" should make a major contribution to increasing the use of contactless technology in card payments. Its use will simplify the payment process, while guaranteeing a high level of security.

- A response to mobile payments: Payment cards are increasingly suffering from the rise of mobile payments in proximity payments. A non-negligible proportion of these flows are in fact picked up by private players such as Apple Pay, and often transit through international networks such as Visa and Mastercard. The absence of a limit on the amount of mobile payments is partly responsible for this rise, to the detriment of the card. Contactless Plus" should therefore enable CB to regain market share in proximity payments.

- Contactless payments are also improved: Contactless payments for transactions under €50 remain unchanged, except in the case of a security check. Certain contactless payments are in fact refused when the customer reaches a certain amount of accumulated contactless or consecutive uses. This security measure, put in place by the banks, resulted in a refused payment that could alter the user experience during the payment stage. Users were therefore obliged to insert their card and enter their PIN code as proof of legal use of the card. With "PIN Online", banks will continue to carry out checks, but in a much smoother way, by simply requesting the PIN code from the payer without refusing payment.

MARKET PERSPECTIVE

- The health crisis has made a major contribution to the development of local payment habits, in particular by encouraging the use of contactless payment. Progressive increases in the contactless payment ceiling, set by European regulations, have also contributed to this global adoption. In a report published at the end of 2023, the Banque de France estimated that six out of ten local payments were made using contactless technology for average amounts of less than €20.

- CB is gradually catching up in terms of digital payments. Last March, the French network also announced its compatibility with the Tap to Pay solution on the iPhone in France, via the Viva.com application.