Cash usage remains predominant in Europe, but its decline continues.

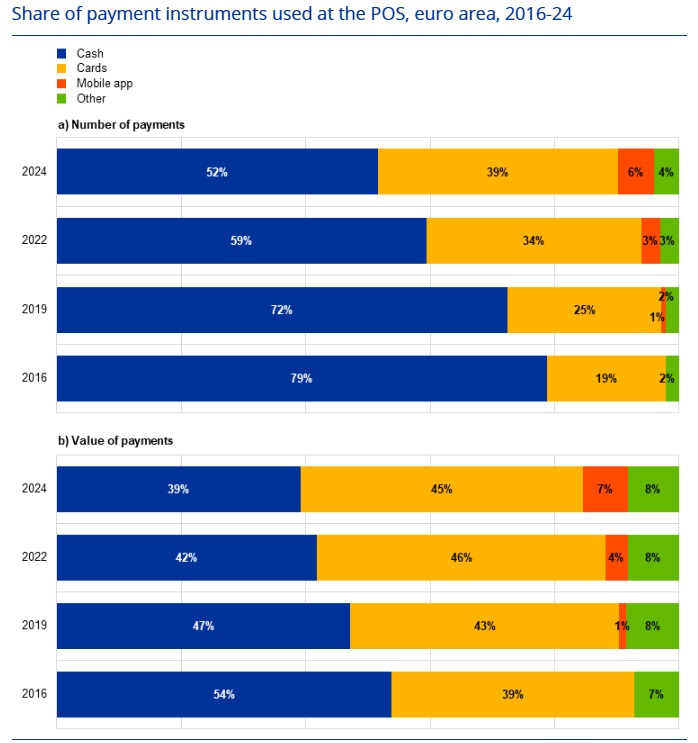

According to a study of the European Central Bank, cash payments still account for 52% of point-of-sale transactions in the euro area, despite continued growth in card and mobile payments. This transition highlights the challenges of digital inclusion and security in the face of the rise of electronic payments.

FACTS

- According to a recent study by the European Central Bank (ECB), cash payments still account for 52% of point-of-sale transactions in the euro area, confirming their most widely used payment status.

- This proportion is down from previous years, indicating an increasing adoption of electronic payments, including card payments (39%) and mobile payments (6%).

- In France, the digitisation of payments is accelerating, with a 5.4% increase in scriptural payments in 2023, totalling 31.1 billion transactions.

- 97% of establishments in Europe now accept contactless payments, reflecting a massive adoption of this technology.

ISSUES

- Digital transition : The gradual decrease in cash use highlights the need for traders and consumers to adapt to digital payment solutions, providing speed and convenience.

- Financial inclusion Ensuring that the entire population, including the elderly or the less technophiles, can access and adapt to the new means of payment is essential to avoid a digital divide.

- Security of transactions : Electronic payments require enhanced security measures to protect against fraud and cyber attacks, a major challenge for financial institutions.

- Regulation and ceilings The limitations on cash payments vary across EU countries, influencing payment patterns and requiring harmonisation to facilitate cross-border transactions.

PERSPECTIVE

- The downward trend in species use is observed in several developed countries, although some, such as Germany and Japan, continue to favour cash, with 73 per cent of people paying in cash over the past 12 months.

- Technological innovations, such as the increase in the limit for contactless payments in France, facilitate the adoption of electronic payments and change consumer behaviour.

- European initiatives, such as the development of digital euro, In addition, they aim to complement cash and meet the needs of citizens in a changing payment landscape.

Traduit automatiquement via Libretranslate / Automatically translated via Libretranslate